A Monumental Further Disaster in the Offing!

High denomination notes of ₹500 & ₹1000, which are 86.4% of the total currency in circulation seized to be legal tender due to demonetisation. The Reserve Bank of India (RBI) denotes these demonetised notes as “Specified Bank Notes” (SBN). As per the RBI Annual Report 2015-2016, as of March 31, 2016, the value of the total SBN is ₹14.18 lakh crores. Volume wise it consists of 15707 million ₹500 notes and 6326 million ₹1000 notes, ie, a total of 22033 million notes. Meanwhile, the total currency in circulation value wise increased to ₹17.975 Lakh crores (November 4, 2016) from ₹16.415 lakh crores (March 31, 2016).

The exact information of the amount of SBN as on November 8, 2016 is now available in the public domain, thanks to a question-answer in the Rajya Sabha, which reveals that 17165 million pieces of ₹500 (₹8.582 lakh crores) and 6858 million pieces of ₹1000 (₹6.858 lakh crores) are in circulation (Total Value: ₹15.44 lakh crores Total Volume: 24023 million pieces) [So my assumptions in my earlier post of value of ₹15.5 lakh crores and volume of 24000 million is almost on target].

To print and replace 24023 billion notes is an enormous challenge considering the sheer volume of notes that need to be printed and the capacity of our printing presses.

Capacity of Printing Presses

How can the Reserve Bank of India (RBI) achieve this target with the resources at their disposal?

How much time will the RBI take for to print and replace SBN with new notes?

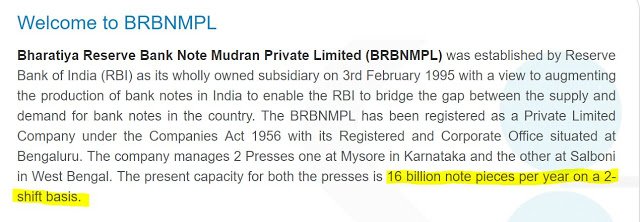

To understand this, from a pure resources management perspective, we have to examine the output capacity of our currency note printing presses. We have two currency printing presses under Security Printing and Minting Corporation of India Limited (SPMCIL), one at Nashik in Maharastra and the other one in Dewas in Madhya Pradesh. Nashik Press was established in 1928 and Dewas was in 1974. Also two more modern currency printing press were added later to augment the printing capacity, one in Mysore in Karnataka and the other at Salboni in West Bengal under the Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL), which were established by Reserve Bank of India (RBI) in 1996.

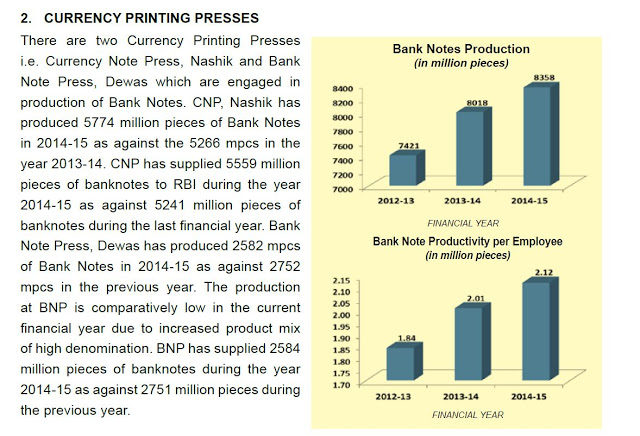

First look at the capacities of Nashik & Dewas presses under SPMCIL. I have relied on the Annual Report of the SPMCIL as well as a presentation available on the internet by the Currency Management Wing of the RBI. From the above records, it is inferred that Nashik Press capacity is 5800 million notes per year and the Dewas Unit capacity is 2620 million pieces.

Meanwhile, BRBNMPL's Mysore & Salboni together can print 16000 million notes in 2 shifts in a year. See the screenshot of the BRBNMPL website. So all these four presses can together print 24420 million currency notes in a year and this is closer to the supply that the RBI has been actually getting for the last 3 years, too.

So all the four presses together have a printing capacity of 66.90 million currency notes/day. If we take Mysuru and Salboni alone, this amounts to 43.84 million currency notes/day.

Printing Abroad is Out of the Question

My next exercise was to understand whether we can outsource this currency printing to any high quality security presses abroad. That research lead me to the Report of Committee on Public Undertakings (2012-13) which deliberates “outsourcing of printing of currency notes” as recommendation serial no.14. A selected extract from the above report is reproduced here:

“The Committee also find it pertinent to point out that during printing of currency notes worth 1 lakh crores in three different countries, there was always a grave risk of unauthorized printing of excess currency notes, which would have been unaccounted money. The Committee simply wonder how come a decision was taken to have the currency notes printed by above mentioned companies in three different countries. Logically speaking since all the said three countries are well developed, each country certainly had the capability of undertaking the entire printing assignment. In any case the very thought of India’s currency being printed in three different countries is alarming to say the least. During that particular fateful period our entire economic sovereignty was at stake.

The Committee is concerned of the grave implications of such a move as it has wider ramifications in a multi faceted angle. The danger of destabilizing the economy by the agencies of authorities who could have misused our security parameters vis-à-vis printing of currency notes, the use of such notes which could have been printed in excess could easily have fallen in the hands of unscrupulous elements such as terrorists, extremists and other economic offenders, looms large in our minds. The Committee expresses its strong resentment over such an unprecedented, unconventional and uncalled for measure. The Committee while recommending that SPMCIL be strengthened to undertake the printing and minting of the required currency notes/coins fervently emphasise that outsourcing of printing of currency notes/minting coins should never be resorted to in the future.”

Reply of the Government

Since corporatisation, SPMCIL and BRBNMPL have been meeting the requirement of coins and currency and no import has been resorted to. The concerns and recommendations of the Committee have been carefully noted for future guidance.

[Ministry of Finance, Department of Economic Affairs]

( O.M. No.3/8/09-SPMC dated 3rd January, 2013 )”

So this assurance rules out the very question of outsourcing of the currency printing abroad. I don’t think RBI can, or will violate an assurance given to the Committee of Public Undertakings of the Parliament. Hence RBI has to depend on the four presses in our country to meet this enormous demand.

Comparison with Demonetisation Exercise in 1977-78

In this context, we have to note that during the demonetisation exercise in 1977-78 only less than 5% of the high value notes were demonetised. It is also important to note that ₹100 note, which was 50.1% of the total currency in circulation was not demonetised during 1977-78. Contrary to the above, this time RBI and Government decided to demonetise ₹500 note, which consists of 47.8% of the value of the total currency in circulation. They also demonetised ₹1000 notes in circulation, thus made 86.4% of value of total currency in circulation redundant, which choked and paralysed the entire cash based economy with a whimsical direction overnight!

₹2000 note – a short shrift solution

Now look at the ₹1000 notes, volume wise their quantity is 6858 million notes. If we convert the entire volume of ₹1000 notes into ₹2000 notes, but keeping the same value, then the volume will be halved to 3429 million notes to facilitate quick printing and disposal.

But there is a catch: RBI has to tweak the ratio between ₹500 and ₹2000 to provide easy change and mobility between these two notes. So obviously, there should be less in volume of ₹2000 notes and more volume of ₹500 notes mandated to keep the equilibrium of the system. For the time being, let us assume that RBI has gone ahead with a complete swap of ₹1000 with ₹2000 notes totally discarding the mobility in the system. This then is a definite, short shrift of an exercise done without considering the much needed mobility and velocity of the demand of the various (multiple) denomination(s) of the currency notes in circulation. Within that scenario too, RBI has to print at least 20594 million notes (17615 million ₹500 &+ 3429 million ₹2000) in a short span of time.

Higher denominations will Aid Hoarding – RBI Study

The elimination of ₹1000 note and the introduction of ₹2000 note is perplexing and the varied explanations by RBI have reduced the institution to a laughing stock. In this context, I invite your attention to RBI Study No. 39 “Modelling Currency Demand in India: An Empirical Study” to explain how, in the past, both the RBI and the Government of India have all along resisted the issue of high denomination notes even when warranted in the short term to meet inflationary goals, considering the fact that there were high chances that this high denomination currency would be used for hoarding purpose(s) by the black money holders.

The irony now is how high value currency note of ₹2000 has been introduced on the guise and pretext of controlling or hoarding black money that it is likely to help transport and hoard! This hasty and irrational decision was taken without considering the statistical principles of distribution of various denominations in the currency in circulation and without taking adequate steps or measures to eliminate chances of hoarding. This short shrift route of going for ₹2000 by the RBI without considering any of the above consequences reflects poorly on the competence and autonomy of the institution that appears to have bowed to some ill-considered wishes of its political masters!

Printing Target – An Estimation

I have discarded here the essential tweak required for the maintenance of the equilibrium between ₹500 and ₹2000 notes and also the increase of currency required to meet the demand of cash in the economy in the coming months until the fallout(s) of this disaster are mitigated. Many of this Government’s sympathisers may point out that the entire amount of ₹15.44 lakh crores of SBN will not return into the system and therefore, there is no need to replace the entire currency. My opinion is that these two factors balance and neutralise each other. Hence for the time being, I have decided to go ahead with the figure of 20594 million new notes as the required target for printing needed now.

In the initial days, the WhatsApp army of government sympathisers were busy forwarding daring claims that only 50% of the SBN will return into the system. Even our Attorney General (Mukul Rohatgi) told the Supreme Court that the RBI & Government expect only a maximum of ₹12 lakh crores of SBN will be return to the system. Today we are hearing another story: from the media quoting Ministry of Finance sources that say that around ₹14 lakh crores worth of SBN has already returned to the system. Remember that we are still 13 days away from the date set by Government to deposit the SBN at banks. So its time for RBI & Government to eat humble pie. It is important to understand that the above cut-off date will not set free RBI’s responsibility to exchange the rest of the currency in circulation at their counters, it only limits the option of depositing/exchanging old notes at the banks. [This is the legal obligation that will be discussed in a future post/article]

Demonetisation Planning – Rajan or Patel?

To understand the currency printing schedule, first see the letter of transmittal dated August 29, 2016 from the RBI Annual Report 2015-16 signed by the former Governor Raghuram G. Rajan. Kindly note the above date, it is very important. We know that the present Governor Urjit R. Patel assumed office on September 4, 2016.

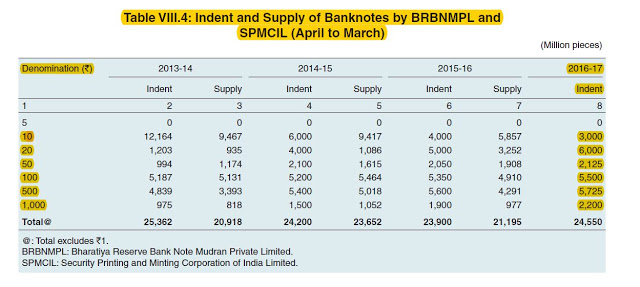

Now look at the same Annual Report again. Look at Table VIII.4, "Indent and Supply of Bank Notes by BRBNMPL & SPMCIL". Look at the indent for the year 2016-17, RBI has given an indent for 5725 million ₹500 notes & 2200 million ₹1000 notes along with other lower denomination currency notes. If there was a plan in advance to demonetise these denominations, then why did RBI print and disburse such large quantities of SBN into circulation? This is nothing but sheer wastage of the exchequer’s money.

Moreover, if RBI had such an advance plan to replace the above SBN, they should have devoted their time and energy to print lower denominations notes instead of SBN. Hence it is beyond doubt that the entire demonetisation plan only came into the picture after Urjit Patel had taken charge. The new denomination note of ₹2000 bear the signature of the new Governor Patel, not of Governor Rajan, which is also another explicit piece of evidence to prove that these notes were introduced after Governor Rajan left the RBI.

When did the Printing if New Currency Begin?

So what could have been the possible date of beginning the process of printing the new currency, yes, after this so called meticulous planning, selling an amazing idea and getting a nod from the higher echelons of power to go ahead with the ‘surgical strike’?

Many theories have been floating around feeding the mystique of ‘meticulous planning’ by a certain section of cheerleader media and court jester journalists. I am not ready to buy any of those theories. We learnt from media reports that the printing of the new notes were confined to RBI’s BRBNMPL presses at Mysuru & Salboni. Neither Nashik nor Dewas of SPMCIL were in the loop, may be due to the secrecy of the mission involved. Another reason may be both these presses were already assigned with printing of the lower denomination notes (from ₹100 downward), which was already intended as is indicated by the huge quantities shown in the annual indent of RBI for FY 2016-17.

Considering all these constraints let me put a rational date before you from a Resources Planning angle. The RBI has disclosed that they have 2473.2 million ₹2000 notes in stock for disposal as of November 8, 2016. This was in response to a RTI query. With the printing capacity of 43.84 million/month of Mysore & Salboni together in 2 shifts, it would take 57 days to print the 2473.2 million notes, which means it started on September 12, 2016. Or take another possibility: that RBI made an effort to enhance printing output to 3 shifts from 2 shifts a day, to ensure that they can print 65.76 million/notes month. This means it could take 38 days; this calculation indicates that the printing started on October 1, 2016 only.

I was really shocked to find that the RBI has admitted that it did not possess a single ₹500 note when they unleashed this chaos over the nation! This really means that the RBI unleashed demonetisation with just 32% of the total SBN in circulation, that too with a less mobile ₹2000 note stock! The RBI themselves would be fully aware that given just a 50 days window period (until December 31, 2016), there was no way they could print the rest of the SBN too!

Disbursal of Currency

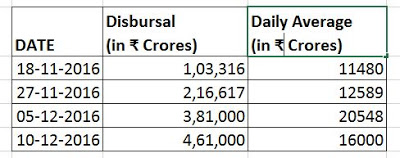

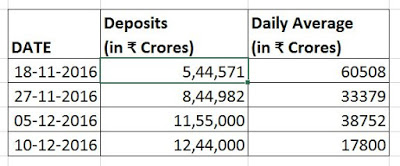

Then, I have looked for patterns of disbursal of currency at various dates, which was inferred from the data provided through the press releases by RBI. Look at the table below:

We can see that there was a substantial increase of disbursal of currency between November 27, 2016 and December 6, 2016 from ₹12589 crores/day to ₹20548 crores/day. This increase is most definitely due to the disbursement of salaries on the first of December. Thereafter, the disbursal began drying up substantially in the succeeding period to ₹16000 crores/day.

If we take the entire 31 days of demonetisation, the average daily release from November 10, 2016 to December 10, 2016 the total figure is ₹14871 crores/day. If the money is disbursed at the above daily average rate, over the next 20 days a further ₹2,97,420 crores can be disbursed. Hence Government may be able to disburse a total of ₹7,58,420 crores or a maximum of ₹8,00,000 crores by December 30, 2016. That means that just 52% of the total SBN going to be disbursed to us. But even this quantity is unlikely to be available given the present printing woes, which I will examine in detail below.

There is some serious cash delivery issue in the system due to inferior planning and poor judgement on the part of RBI as well as Finance Ministry. Otherwise what is the justification of various new restrictions unleashed on a day to day basis by the RBI without respecting the notification dated November 8, 2016? It is quite depressing to see that even the address to the nation by the Prime Minister has not been not honoured!

RBI deleting Information – why?

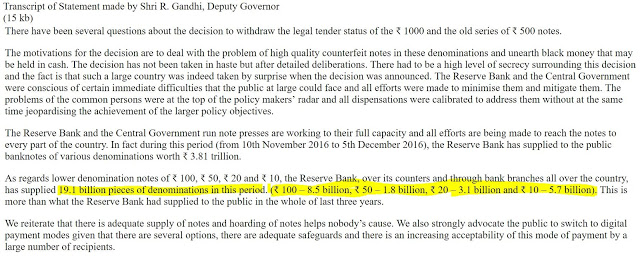

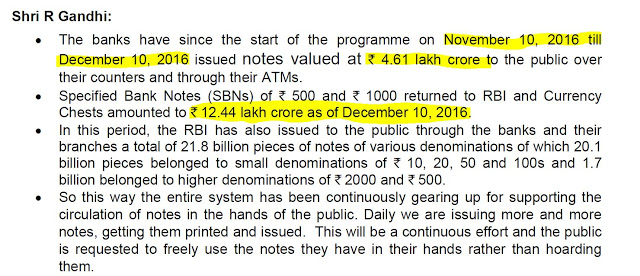

While looking for these data, I met with a really shocking finding. RBI published a transcript of the statement given by R. Gandhi, Deputy Governor on December 7, 2016 on its website under the title "press releases". But later it is seen as purged from the RBI website!

In the meantime, the video of the press conference is still available on the internet (https://www.youtube.com/watch?v=IuSzeRX31ms). This really made me curious. What information was there in the above transcript, which forced RBI to delete it from the website, even sacrificing the very institution’s credibility?

What is there to hide from the public which was not there in the full video coverage of 5th bi-monthly monetary policy press conference 2016-17? Interestingly, the RBI which deleted the transcript of R. Gandhi forget to wipe it out that from the cache, so one of my friend’s on twitter grabbed the information from there and shared it with me. See that transcript of R. Gandhi here!

It is quite an irony that the very RBI, which is today exhorting us to go cashless by embracing digital modes of payment, did not even know the primary lessons of digital literacy of how to purge a document from their own system! Look at the highlighted information – this is not available in the video but provided in the transcript, which RBI has since, deleted. What is the relevance of this information? It can lead you to the printing volume of new notes disbursed by RBI as of December 10,2016, which they have refused to divulge so far.

Details of Denomination-wise Disbursal of Currency

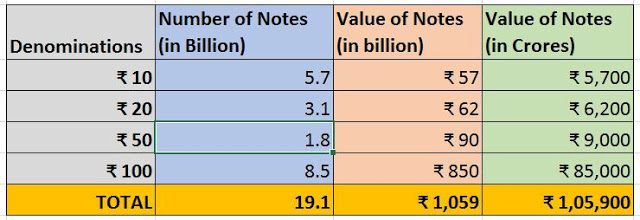

Look at the total value of the lower denomination notes of 19.1 million disbursed by RBI from the above. It totals only to ₹1.059 lakh crores! That means the higher denominations notes are ₹3.81 lakh crores minus ₹1.059 lakh crores = ₹2.75 lakh crores. As RBI has not given the volume of high denomination notes, I was not able to decipher the possible numbers of them.

But at its next press conference on December 13, 2016, RBI provided the numbers to decipher the new currency notes in the system. Look at the statement of R. Gandhi, the Deputy Governor.

Here Gandhi claimed that 19.1 billion notes of lower denomination on December 5, 2016 was increased to 20.1 billion on December 10, 2016 and meanwhile also claimed that the RBI disbursed 1.7 billion higher denomination notes of ₹2000 & ₹500 notes.

As the amount of the total cash disbursed is now shown at ₹4.61 lakh crores, it turns out to be a simple mathematical problem to solve. There is a limit to how much lower denomination notes will fluctuate, as we know that their denomination-wise quantity to be at 19.1 billion notes in circulation. So, if 19.1 billion lower denomination notes in circulation increased to 20.1 billion notes, two borderline scenarios emerge:

- If the entire 1 billion volume increase are of the ₹100 notes, then their total value will be increased by ₹1.159 lakh crores

- if the entire 1 billion volume increase are of the ₹10 notes, then their total value will be increased by ₹1.069 lakh crores.

- This simply means that the value of higher denominations notes will be in the range of ₹3451 crores to ₹3541 crores.

- So, now, if the entire higher denomination notes are in notes of ₹2000, then their volume will fluctuate between 1.7 billion to 1.8 billion.

If Deputy Governor, RBI Gandhi had not have revealed the exact volume-wise distribution of each lower denomination note, on December 7, 2016 (in the transcript of his press conference), we would not have been able to arrive at these scenarios. My strong feeling is that this is the very reason why the RBI later deleted the said transcript from its website.

You cannot introduce more than a couple of million ₹500 notes into this equation, as in that case the volume of higher denomination notes will go up from the estimated 1.7 billion! Even after a month after unleashing the demonetisation on our heads, the RBI has not been able to disburse any substantial quantity of ₹500 notes into circulation, which are the most essential denomination for the reasons I cited in my previous blog post.

That is why we are not seeing these notes in the market and feel the burn of cash crunch so badly. It is a shame on the RBI to flash a couple of million notes of this ₹500 notes in only metro cities and major urban centres for a limited purpose of optics management before the 24×7 electronics media and to flaunt in WhatsApp forwards & re-tweets on social media! It is really sad to see that a reputed professional organisation like RBI is letting down the nation with such cheap tricks rather meeting the wider population’s pressing demands!

Lower Denomination Notes Disbursal – a Record??

Gandhi told us at the December 7, 2016 press conference that the RBI has provided 19.1 billion lower denomination notes after demonetisation, which is a record as it is more than what the Reserve Bank provided in last 3 years to the system. If we look at the indent & supply for last FY year, from the above table, we can see that around 16 billion lower denomination notes were printed then. This FY year, too, RBI had given an indent order to print 16.6 billion lower denomination notes and if the presses print according to their capacity, there will be new notes worth Rs 12.5 billion notes until December 10, 2016. Along with this quantity, there will be soiled notes which are being collected (for disposal) during this FY (Kindly note that, last year alone around 13 billion lower denomination soiled notes were disposed off), which are also pushed back into circulation as we see lots of old soiled notes back. Also note that the total number of lower denomination notes in circulation as of March 31, 2016 was 56.6 billion. It is interesting to note that Gandhi never claimed RBI has printed 19.1 billion notes, instead he only made a tall claim that these notes represented a record volume! The media never asked any questions to him and Gandhi basked in glory! I am sorry I am more of a sceptic.

Where is that ₹500 note?

Let us come back to the figure of 1.7 billion high denomination notes disbursed by December 10, 2016. This information is quite perplexing when we compare the printing press capacities. We have seen that RBI had a stock of 2.473 billion ₹2000 notes as on November 8, 2016 itself. So if these printing presses were working at least 2 shifts/day, there would have been another 1.4 billion pieces of ₹2000 & ₹500 with RBI by December 10, 2016 (32 days x 43.84 = 1403 million).

To completely replace, the ₹1000 notes by ₹2000 notes, RBI needed to print 3.429 – 2.473 = 0.956 billion pieces. So RBI should have, by December 10, 2016 printed the entire ₹2000 notes to replace the ₹1000 notes. I hope and pray that RBI did not go ahead with another short shrift solution of printing more ₹2000 notes to replace ₹500 notes after being done with the older ₹1000 notes, which will completely disrupt the mobility and balance of the currency in circulation.

Why then is RBI holding the rest 1.729 billion of ₹2000 notes (3.429-1.7=1.729) without disbursing this to the public?

From the above we see that a quantity of 0.444 billion ₹500 notes (1.4-0.956=0.444) printed after de-monetization are with RBI, but a few million only have been disbursed to public. It is really perplexing why the RBI is not distributing these ₹500 notes in substantial quantities? This is quite baffling because RBI through its press releases informed the Indian public that they disbursed ₹500 notes with the following series numbers:

without inset

with E as inset

with L as inset,

E and star as inset and

with R as inset.

This indicates that various printing presses have been put to the task of printing the ₹500 notes, but as we are not seeing much of these ₹500 notes in circulation, and there is speculation and fear that some issues have cropped up during its printing. Recollect the media reports of two different design ₹500 notes being wrongly circulated and the RBI's bizarre explanation.

The RBI informed us that up to December 10, 2016, they have disbursed 1.7 billion high denomination notes. This will definitely be 1.7 billion ₹2000 notes and a few million ₹500 notes, as I have shown above. Also relying on the above printing calculations & the RTI disclosure, we can very well conclude that RBI may have a stock of at least 1.7429 billion ₹2000 notes and 0.444 billion ₹500 notes as of December 10, 2016.

In the above context, let me put some questions to RBI:

- Why you are not disbursing sufficient amounts of ₹500 notes into circulation to ease the mobility crisis?

- Why you are not disbursing enough ₹2000 notes and imposing unreasonable restrictions on withdrawal of our own money deposited in the banks?

- Inform us whether the above stock of notes has any relation to the hoarding of huge quantity of currency notes seized from various parts of the country?

- What is the exact quantity of ₹2000 notes and ₹500 notes printed and disbursed so far?

- Have your printing systems faced any unexpected failure & are you struck?

- Please share the exact schedule and output of printing of various denomination of notes at various presses under the RBI and SPMCIL

When will we get back our currency?

Now we have to consider when we will get the ₹500 notes demonetised from the system back. As we have seen from the above, as many as 0.444 billion ₹500 notes would have been printed up to December 10, 16; then how much more time will the RBI take to print remaining 16.721 billion pieces (17.165-0.444=16.721)?

In this context, I am giving you three possible scenarios considering the printing capacity of our four currency printing presses. I have not considered certain constraints here, like additional skilled manpower needed to introduce a 3rd shift for a prolonged period, raw material supply constraints, machinery maintenance, forced plus routine shutdowns and other surprises which can crop up anytime. Also, I have not considered additional output (?) possible with the reduced size of new notes too as some have argued.

I have gone ahead with a perfect printing mechanism with sufficient manpower and resources at disposal. So this estimation must be taken with a pinch of salt.

First Scenario

Mysuru & Salboni (3 shifts/day) AND Nashik & Dewas

@88.82 million/day needs 188 days –June 16, 2017

Second Scenario

Mysuru & Salboni (3 shifts/day) AND Nashik

@ 81.64 million/day needs 204 days –July 2, 2017

Third Scenario

Mysuru, Salboni (2 shifts/day) & Nashik

@ 59.73 million/day needs 280 days –September 16, 2017

These are the earliest possible dates within which the RBI will be able to replace SBN with new currency from a purely resources management angle.

Looking at the above earliest dates make one shudder.

I don't know when the normalcy of the system will be restored!

Remember, our Prime Minister on November 8, 2016 sought first a couple of days to restore normalcy . This will give you an idea about the planning prowess of the mandarins in both RBI and the Union Finance Ministry. Ask ourselves whether we have fallen into a rabbit hole? We Indians still believe in magic and we bear all subjugation as our bad karma or destiny. But here no magic wand has been left to create miracles, we are destined to silently suffer this onslaught for at least half a dozen months more.

Estimation of Possible Return of SBN

Now look at the way SBN is coming back to the banks. This table extracts information from various press conferences.

This table will explain to you why the Government & RBI are panicking and imposing new restrictions (like deposits up to ₹5000 to non-KYC accounts and questioning people depositing more than ₹5000 into their KYC accounts).

Why we are treated like criminals?

Under which legal or constitutional provision Government and RBI arbitrarily gives this police power to the bank authorities to abuse us?

This is becoming a theatre of absurd. This very Government is reluctant to reveal the names of celebrities and big shots who keep thousands of crores of black money abroad arm is now arm-twisting the common man and honest tax payers!

Look at various possibilities that will accrue on December on 30, 2016

- With an average daily inflow of ₹15000 crores, entire SBN valued ₹15.44 lakh crores will return to banks

- With an average daily inflow of ₹12800 crores, total SBN valued ₹15 lakh crores will return to banks

- With an average daily inflow of ₹10300 crores, total SBN valued ₹14.5 lakh crores will return to banks

My strong belief is that SBN valued around ₹15 lakh crores will most probably return to the system, rest of the SBN will be trapped in Nepal & Bhutan and other countries for the time being. If ₹15 lakh crores of SBN return, then it will totally shatter and tear away all mighty claims by the Government and RBI that a maximum of ₹11 lakh crores to ₹12 lakh crores of SBN will only return to banks.

Then the entire demonetisation hungama will fall apart as a monumental disaster, yep, its now just a matter of time..only 7 more days to go to the deadline set by our Prime Minister in his November 8, 2016 speech!

(This article appeared on the author's blog and is being reproduced with some minor editorial changes with his permission.)