Demonetisation 2016 – Recap

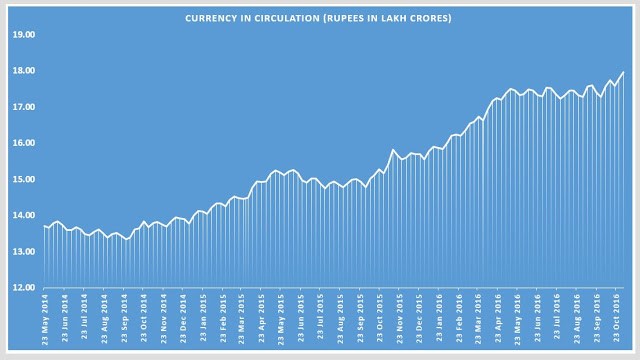

In 2016, the Indian government introduced a demonetisation policy. At that time, India’s cash-to-GDP ratio was only 12%, lower than Japan’s 20%, Germany’s 15%, and Switzerland’s 10%. The majority of cash in circulation were 500 and 1000 rupee notes. Before the policy, currency in circulation had steadily increased and reached 16.42 lakh crore rupees. As of March 2022, the Indian currency in circulation has significantly risen to Rs 31.33 lakh crore from Rs 13 lakh crore in 2014. The demonetisation policy is still a significant disaster in India’s economic history.

It’s important to mention that RBI favoured increasing cash circulation before the demonetisation event. You can find more information in the attached article.

https://thewire.in/economy/

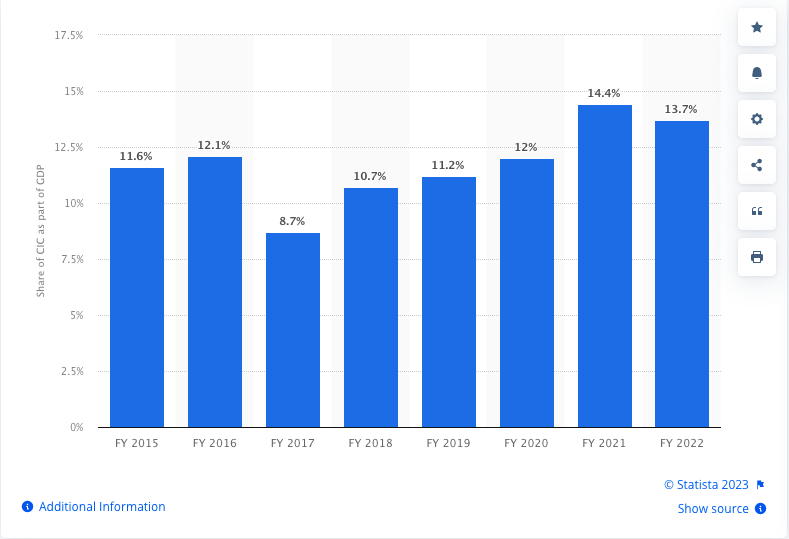

During the fiscal year 2022, the proportion of currency in circulation (CIC) to India’s gross domestic product (GDP) was almost 14%. Following the demonetisation in 2017, the CIC ratio significantly increased once again.

Share of currency in circulation to GDP in India from the financial year 2015 to 2022

‘Velocity’ of money and Currency Denomination

The ‘Velocity’ of money measures how quickly money is exchanged in an economy, indicating the economic activity level. For instance, if ten people use 100 rupees within a specific time frame, it generates an economy worth 1000 rupees, showing the impact of money circulation. The ‘Velocity’ of money is a crucial factor in determining economic health because it reflects how often and how fast money moves within an economy, driving transactions and promoting economic development.

In the economy, the denomination of currency plays a vital role in the ‘Velocity.’ of Money.

To understand this concept, let’s use an example where you have a 200-gram weight and a weighing machine. Giving your neighbour 130 grams of sugar using a 200-gram weight would be impossible. You can measure accurately if you have standard weights like 100 grams, 20 grams, or 10 grams, and a standard set of weights allows you to provide or sell the desired weight.

Similarly, if you want to purchase something for 130 Rupees, it’s crucial to have a combination of currency denominations that adds up to that amount. Having 100-Rs, 20-Rs and 10-Rs notes would allow you to pay seamlessly. In contrast, having only one unit note would be impractical and inconvenient, and a high-value denomination like a 2000 unit note would be challenging to use for smaller transactions efficiently.

To ensure smooth transactions, currency notes come in various denominations that align with the average ticket size of transactions in a country. For example, the Reserve Bank considers typical transaction amounts when printing money in India. By providing a range of denominations, currency notes enable practical and convenient transactions, allowing individuals to make payments efficiently according to the value of goods and services they purchase.

Demonetisation – November 8, 2016.

On the day of demonetisation, a massive sum of 16.43 L crore was withdrawn from the economy, leaving a void that needed to be filled. Let us use an example to understand the options available.

● Printing only 2000 Rs notes 821.5 crores of 2000 rupee notes

● Printing 50% 100 Rs and 50% 500 Rs notes 8.215 lakh crores of 100 rupee notes and 1.643 lakh crores of 500 rupee notes.

During demonetisation, it would have been quicker to print 2000 rupee notes compared to 500 and 100 rupee notes. This could have influenced the decision to print more 2000 rupee notes to speed up remonetisation. The decision to demonetise was likely made only a few days before the event, and the RBI had to print the necessary currency without seeking expert opinions or following a well-planned program.

The abrupt elimination of currency caused chaos and difficulties, leading to despair and loss of life. When the economy was re-monetised, the circulation of only 2000 rupee notes worsened the situation. The effects of demonetisation were significant – the ‘Velocity’ of money decreased significantly due to a lack of currency, bringing the economy to a halt; the introduction of the 2000 rupee notes delayed the recovery accentuating the problem and hurting the economy further.

It was a tough time for everyone involved, and the effects were felt for a long time.

Conclusions

If you struggle with being overweight, you cannot run like a ‘forest gump’ and lose weight overnight. Creating a plan that includes exercise and a healthy diet is essential.

In the same way, transforming the economy is a gradual process, and military terms like “surgical strikes” are just marketing tactics that don’t address the issues at hand. Demonetisation was a disastrous step that revealed a crucial lack of economic understanding, and it disrupted the circulation of money, and introducing the 2000 rupee note only further delayed recovery.

The RBI reports that the value of these banknotes in circulation has gone down from ₹6.73 lakh crore on March 31, 2018, which accounted for 37.3% of all notes in circulation, to ₹3.62 lakh crore on March 31, 2023. This now represents only 10.8% of all notes in circulation.The discontinuation of the 2000 rupee note and the deposit limit of ₹20,000 per visit creates unproductive work for banking staff. The impact on those who travel to make deposits and the opportunity cost are still unknown. This exercise is a waste of resources and causes a loss of productivity.

It would have been prudent if the Reserve Bank of India had gradually reduced circulation without a big announcement.

The mistake made in 2016 by a leader who acted without seeking consensus or expert advice has become even more apparent. Unfortunately, we are all now paying the price for this decision.

The author is a financial professional with a master’s degree in economics. He is interested in the arts, academia, and social issues related to development and human rights.

Also Read:

Related:

RBI data reveals demonetization was a failure, 99% of banned cash recovered

Money Mayhem – Demonetisation Cartoons

Demonetisation: The grandest of blunders made by anyone in Indian political history?