Accused of toeing Modi’s line of favouring corporate houses, the amendments to the age-old Chotanagpur Tenancy (CNT) Act and Santhal Pargana Tenancy (SPT) Act, passed through a voice vote that will irrevocably change they the occupancy rights of tribal over land

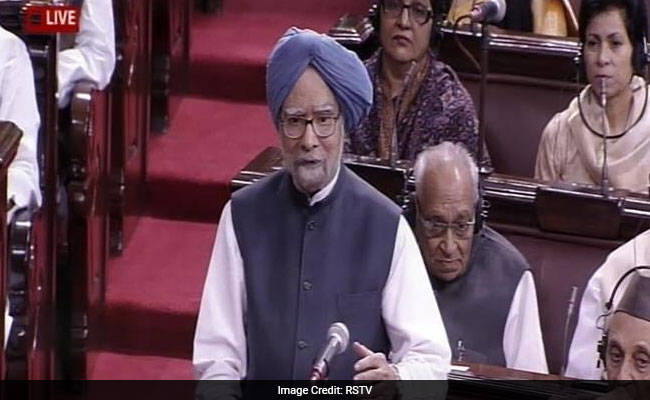

Water cannons to tame ruckus Image: Telehraph/Vijay Deo Jha

The Opposition's fierce protest against the Bills to bring amendments to the age-old Chotanagpur Tenancy (CNT) Act and Santhal Pargana Tenancy (SPT) Act spilled on to the capital's roads today, as the combine of the JVM-RJD-JDU and the Left held a march and staged demonstrations, inviting a showdown with police who had to use water canons and teargas shells to tame the crowd.

The Telegraph reported that, both in the assembly and on the streets the protests were loud. If the Assembly, where the Bills were passed by voice vote, witnessed utter pandemonium, outside it, the scene was no less chaotic, thanks to a mob of over 500 that laid siege to a key artery like Harmu bypass. Tomorrow, November 25, the state will witness a complete bandh called by the opposition political parties.

Over the past months, but since October 2016 particularly, the Jharkand government has been deploying force and the use of the gun to quell tribal protest in Jharkand: On Saturday October 1, 2016 a tribal agriculturist died a bloody death while protesting peacefully to save his land, and behind the killing of 5 Tribals, was the sordid story of the illegal acquisition of land by the NTPC: Hazaribagh. Sabrangindia had reported on the sinister nexus between the state police (Jharkand, a state ruled by the Bharatiya Janata Party,BJP) and the Modi regime is revealed as the illegal acquisition of land by the NTPC in Barakagaon, as this acquisition has been coercively undertaken without the approval, statutorily mandated, by the Gram Sabha.

JVM chief Babulal Marandi and other party leaders during the march on Wednesday. (Prashant Mitra)

Union minister and Hazaribagh MP Jayant Sinha who came to assess the situation today at NTPC's Pankri Barwadih coal mine, Barkagaon, in the wake of the October 1 police firing on a land acquisition protest that killed five people, could not visit the site due to Section 144 of CrPC clamped in the troubled spot, but despite this, was quick to give a clean chit to the police after seeing video footage of that day. Admitting innocents became victims – three teenage students and a young tailor, whose relatives said they had no involvement in the protests, had fallen to the bullets – Jayant urged villagers not to be curious onlookers at times of trouble.

Wednesday’s agitation, led by JVM chief Babulal Marandi, started at Argora grounds where the protesters assembled at 11.30am. Marandi was joined by party colleague Bandhu Tirkey, RJD president Gautam Rana and former RJD minister Annapurna Devi, CPI leader Bhuvneshwar Mehta and state JDU president Jaleshwar Mahto.

While JMM kept itself away from the show of Opposition unity, state Congress also turned down Marandi's request to join the march. But former Union minister Subodh Kant Sahay was present with some supporters. Around 12.30pm, the protesters started walking from Argora grounds towards Vidhan Sabha. While the administration had given permission for the agitation only at Birsa Chowk and notified the route for the march via Ashok Nagar, the protesters changed their path at the last moment and decided to head directly to Satellite Colony from Argora.

Barricades were already set up at Satellite Colony Chowk, Birsa Chowk and Sector 2, where over 300 policemen thwarted the protesters' attempts to move ahead towards the Assembly.Enraged, the Opposition members squatted on Harmu bypass at Satellite Colony Chowk near DPS School, around 2km from the Assembly. As the air pulsated with high-pitched slogans, the leaders delivered speeches one after the other.

"Today is a black day for democracy. Chief minister Raghubar Das wrote a script that will bring doomsday for people of Jharkhand. He has proved his loyalty towards corporate houses. The amendments have been introduced with no good interest. Once implemented, they will change the occupancy rights of tribal over land," Marandi said.

Annapurna Devi of RJD alleged that Das was pushing for the anti-tribal, anti-minority and anti-dalit agenda of the BJP through the amendments.

"Das is toeing the line of Prime Minister Narendra Modi, who tried to change the Land Acquisition, Rehabilitation and Resettlement Act, 2013, passed by the UPA government. But Modi had to buckle down under pressure from the Opposition and the people of the country," she said.

Sahay flayed the government for using force to stop people from raising their voices.

Marandi's party colleague and MLA Pradeep Yadav, who joined the street show right after the Assembly adjourned, said the fight against the amendments would become more intense than ever.

After Yadav finished his speech, the protesters went on the rampage, trying to break through the barricades. Police used tear gas and water canons to control the frenzied crowd. They also resorted to lathi-charge in which RJD worker from Dhanbad Tarkeshwar Yadav got injured.

Around 100 protesters, including Marandi, Mahto, Tirkey and Mehta, were arrested. They were later released.