But the government squeezed funding of various welfare schemes in the name of lack of resources.

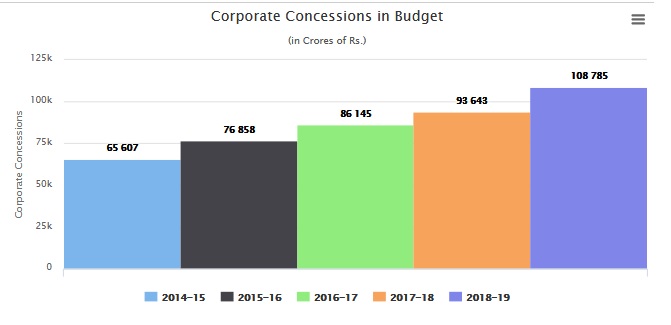

During its first term at the Centre, the Modi-led Bharatiya Janata Party government provided tax exemptions to corporate entities amounting to a whopping Rs. 4.32 lakh crore, according to Budget documents of various years. The amount of concessions increased every year from Rs. 65,067 crore in 2014-15 to about Rs.1.09 lakh crore in its last year, 2018-19. On an average, these concessions amounted to about 7.6% of the net tax revenue of the central government.

To see the scale of these concessions in perspective, have a look at what the government has been spending on different schemes and programmes that are meant to provide relief to people or uphold their welfare. The rural jobs guarantee scheme (Mahatma Gandhi National Rural Employment Guarantee Scheme) has been allocated Rs. 60,000 crore for 2019-20, mid-day meal scheme has been given Rs. 11,000 crore, anganwadi services (under the Integrated Child Development Services scheme) has got Rs. 23,234 crore, etc.

In fact, the amount allocated to various key departments this year is less than the amount of concessions given to corporates: department of health and family welfare is planning to spend Rs. 62,659 crore; department of school and literacy, Rs. 56,537 crore; department of higher education, Rs. 38,317 crore; department of drinking water and sanitation, Rs. 20,016 crore, and so on.

What are these exemptions? In a statement which is included as an annexure to the receipt budget, these tax concessions are defined by the government as “an indirect subsidy to preferred tax payers”. The government has been calling them “tax incentives” or “tax expenditures” since 2015-16, although earlier they were called “revenue foregone”, that is, potential revenue of the government which was foregone or not received by giving the concessions. Arguing that these concessions “could be seen as targeted expenditure for the promotion of certain sectors”, it is believed by the mandarins of finance ministry that giving such concessions could help generate employment or economic development.

The statement giving details of these and other tax exemptions (like those to individuals under income tax rebates or waivers, or to charities and religious trusts) provides a list of corporate concessions. This includes concessions given to units operating in Special Economic Zones (SEZ), those involved in key industries like power, minerals and natural gas, housing, and even to offshore banking units and ‘international financial centres’.

The trend of giving exemptions from taxes was not started by the BJP government. It has been going on forever. People became aware of its exact scale only since 2006-07, when a statement was included in the Budget. Under the UPA too, such exemptions were given. In UPA 2, the total amount of such tax exemptions was about Rs. 3.52 lakh crore. Clearly, the Modi government has not just continued with the policy but done so with greater enthusiasm, increasing the waivers by over 22%.

These tax exemptions to corporates underline the hollowness of repeated claims made by the government that it has limited resources to deal with various needs. It has been said that increasing resort to private investment (or Public-private Partnership) has to be made in order to fund various essential services. This argument comes up when it is pointed out that education or health infrastructure needs more funding, or that railways needs more capital investment or that farmers need irrigation systems based on surface water through canals.

Yet the government is willing to exempt a huge slice of taxes that could be levied on corporates. The argument that this would encourage the corporate entities to invest more, leading to more employment and output has fallen flat on the face because in the past five years, private investment in productive capacities is stagnating, not growing. All the concessions given to corporates have only helped boost their profit margins rather than employment or capacities.

In short, the concessions or exemptions to corporates are simply the central government’s way of helping the social segment that it represents.

Courtesy: News Click