Despite a 11% rise in loans to agriculture over a year to a record Rs 10 lakh crore in 2017-18, the share of professional moneylenders in agricultural credit grew nine percentage points over 11 years to 2013, and two important government programmes meant to ease credit are denying farmers the benefits they seek, according to an IndiaSpend analysis.

While the 19-year-old Kisan Credit Card (KCC) Scheme, hopes to allow farmers to double their incomes by providing them with crop loans at interest rates as low as 4% to purchase better farm equipment, seeds and an ATM card to meet household expenses, some farmers are made to pay insurance premia they don’t want; others are forced to take informal loans to pay the KCC interest on time.

The second programme is the decade-old Agricultural Debt Waiver and Debt Relief Scheme (ADWDRS), which allows farmers to have direct agricultural loans waived by issuing full waiver certificates that qualify farmers for fresh loans, or by partial waivers that are credited to their accounts. But 44% of rural houses that borrow from informal credit sources are ineligible because ADWDRS loans are formal loans from banks or other financial institutions, and one in three eligible farmers over ten years to 2007 did not receive the certificates they needed to apply for new loans.

For perspective, Rs 10 lakh crore is 5.3 times the size of India’s agriculture and rural budget and 20.4 times the health budget for 2017-18.

In the first part of this series, we investigated how growing farm debt is associated with increased farmer suicides in an era of climate change and crop failures, increasing dependence on professional moneylenders charging interest that can be four times higher than the banking system.

In this second part, we explain how the government budget spends more than ever on agricultural credit and although official programmes have helped farmers earn more money, loopholes and inefficiencies withhold benefits, and eventually force them towards moneylenders and other informal sources of credit.

The continuing–and growing–lure of moneylenders and other informal credit

Professional moneylenders–who can charge up to four times more interest than the government’s banking system–hold more rural debt than ever: From 19.6% in 2002 to 28.2% in 2013.

The government has constantly tried to improve agricultural credit: By nationalising commercial banks in 1969–so they could be forced to lend money to the agricultural sector– to setting up regional rural banks in 1975 and the National Bank for Agriculture and Rural Development (NABARD) in 1982.

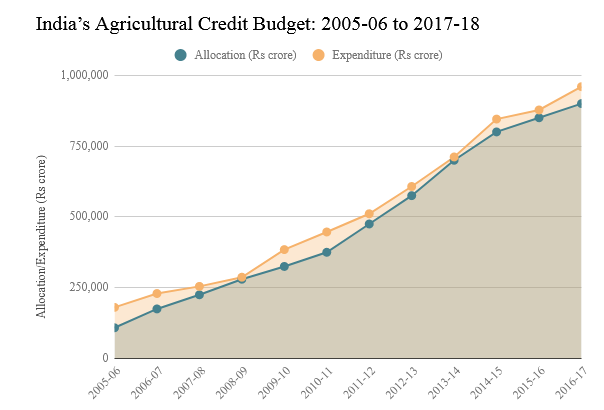

In 2017-18, as we said, the government budget of Rs. 10 lakh crore towards agricultural credit, was the highest ever, up from Rs. 9 lakh crore the previous year and a 9.3 time increase from Rs. 1,08,500 crore in 2005-06.

Source: AGRICOOP Annual Reports, India Budget.

From 2005-06 to 2017-18, the budget allocation towards agricultural credit has increased 9.3 times— to Rs. 10,00,000 crore.

Though the government has always spent more than its budget towards agricultural credit–105.6% in 2012-13, for instance–rural households continue to borrow money from informal sources (moneylenders, family and friends) because conditions are flexible and often no collateral is required, as we mentioned in the first part of this series.

We analysed two well-meaning government programmes–the KCC and the ADWDRS–to explore why the government fails to displace informal sources of rural credit.

Kisan Credit Card may lead to higher incomes, but also involuntary insurance premia

The KCC was introduced in 1998, so farmers could purchase seeds, fertilisers and pesticides on credit and withdraw cash through ATMs, subject to credit limits. In 2004, the KCC was expanded to include term loans for agriculture and allied activities. For marginal farmers (those who own up to 2.5 acres of land) KCCs are more flexible, covering warehouse-storage credit, consumption expenses and small-term-loan investments to purchase farm equipment or start mini dairies.

Farmers with a KCC could earn nearly Rs 1.49 lakh every year, according to this 2016 NABARD estimate, double the Rs. 69,850 they might earn without one.

But a KCC automatically registers farmers with a crop-insurance programme, regardless of consent, and money is deducted from their bank accounts as premia towards crop insurance that they may not want, The Wire reported on 31st March, 2017. Some farmers have not received insurance payouts, despite paying these premia.

Eligible farmers denied necessary certificates, some benefits routed to ineligible beneficiaries

In 2008, the government of India announced the ADWDRS, which allowed the waiver of debts related to direct agricultural loans given upto March 31,2007 and overdue as on 31st December, 2007, if these loans remained unpaid up to February 29, 2008. Small and marginal farmers would receive 100% waivers, while other farmers would receive a rebate of 25%, provided they paid the balance 75%.

Nearly 13.5% of eligible farmers did not receive benefits amounting to Rs.3.58 crore, according to a 2013 CAG report on the 2008 debt-waiver scheme. Instead, 8.5% of farmers who received benefits were ineligible–these loans were for non-agricultural purposes; the CAG report does not say how they got these loans–and their waivers amounted to Rs. 20.5 crore.

Debt-waiver certificates were not issued to 34% of eligible farmers. Farmers need these certificates to apply for fresh loans. Loans amounting to Rs. 164.60 crore were waived in violation of the scheme’s guidelines.

Farmers return to informal sources despite loan waivers

Only farmers who borrow from formal sources, such as banks, are eligible for loan waivers. As we reported, nearly 44% of rural debt is held by non-institutional agencies.

However, those who borrow from institutional sources only get a partial waiver, as a large portion of their expenses is non-farm related. Some farmers hold multiple loans, which means they need multiple loan waivers. Agricultural labourers who do not hold crop loans are not considered.

Some households who received full waivers went on to increase their borrowings from informal sources, and such waivers can encourage future defaults, according to a 2011 World Bank study.

Despite crop failures, farmers were eager to repay their KCC loans, which are interest-free if paid within a year, according to a 2017 study by Stanford University’s Center on Global Poverty and Development. So, they take loans from informal sources at high rates of interest. Once the new KCC loan was given, they used it to repay informal lenders, leaving them with lower incomes.

States with a high proportion of indebted farmers reported a higher share of informal loans, making these farmers ineligible for debt waivers, according to a 2017 RBI paper.

To provide credit at an affordable rate to boost agricultural productivity, in June 2017, the Union Cabinet approved an Interest Subvention Scheme, which allows farmers to access short term loans upto Rs. 3 lakh at 4% per annum.

(Nair is an intern with IndiaSpend.)

Courtesy: India Spend