- Tax system in india has been gruesome and tedious process for the honest tax paying citizens who choose to avoid trouble during “surgical strikes” on black money.

- The multiple taxation system by the Centre as well as the States has great cascading effects.

- For example, if trader buys office supplies for Rs. 20,000 paying 5% as tax. It charges 15% service tax on services of Rs. 50,000. Currently, he has to pay Rs. 50,000*15% = Rs. 7,500 without getting any deduction of Rs. 1,000 VAT already paid on stationery.

- In order to overcome these snags, the government proposed the Goods and Services tax, which seeks to combine the taxes levied by the Centre and the States.

- It is a consumption based tax i.e. the tax will be received by the state in which the goods or services are consumed and not by the state in which such goods are manufactured. The Centre levies intra-State tax on supply of goods and/or services called the Central GST (CGST) while that levied by the States is called State GST (SGST).The Centre levies Integrated GST (IGST) in case of inter state transactions.

- The GST council will determine the tax structure and the tax rates to be levied and will consist of the Union finance minister as the chairman, the Union Minister of States and Minister representing each of the states.

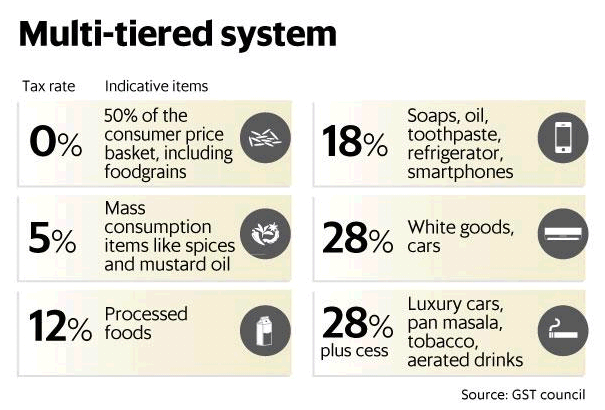

- However, our concern is GST has changed its colour over time. Initially it was conceived to be a single uniform rate across all product categories, but the shape that the GST has taken is far removed from the actual concept of one country-one tax. What instead we have got is a multi-ties tax structure with 4 different tax rates –5, 12, 18 and 28 per cent. Besides, there would be exempted and zero-rated goods, which means there would be at least six different categories of products under GST.

- The government is planning to set up an authority to see if any reduction in tax rates after GST is passed on to the consumer by companies or not. The problem behind this? This could be a backdoor entry of inspector raj. Experts say that prices should be market determined and no government authority has the business of deciding prices for goods and services.

- Rajat Mohan, director, indirect taxation, Nangia and Co. said that "The bigger issue in this is valuation. If stage one of a good is manufactured in Delhi, stage two in Noida and stage three in Faridabad, how would a company value the goods at different stages. The GST law does not give a formula for valuation and this could create dispute between manufacturer of goods and services and the tax department." Businesstoday

- Amongst the haullabaloo about GST, one major aspect is being ignored, that is, the aspect of federal structure. The GST council will determine the rates that the states are supposed to levy, which is in violation of the basic structure of the Constitution of India.

- It is essential to be noted that different states have different revenue requirements and also they deal in different goods and services. It might become difficult for the Centre to cater to the requirements of each individual State and Union territory.

- In essence, with the GST coming in, the States lose their autonomy to deterime the tax rates, which might vary from one state to another. Consequently, it will increase the dependence of the States on the Centre.

Currently the GST rates around the world are as follows:

Australia —-10%

Bahrain—– —–5%

Canada —- —–5% (GST) HST 9.975%- 15%

China ————–17%

Japan — ——-8%

Korea — ——10%

Kuwait—— —–5%

Malaysia — —-6%

Mauritius — —–15%

Mexico— —-16%

Myanmar ———-5%

New Zeland — —-15%

Phillipenes — —12%

Russian Federation-18%

Singapore——– 7%

South Africa-14%

Thailand —— —7%

UAE ————-5%

USA….0- 7.5%

Vietnam ——10%

Zimbabwe —- —-15%

India —— —– >18%- 28 %

- Many countries have, immediately after the implementation, slashed the rates of the GST, which is a hunch in case of India as well, as the GST rates in India are proposed to be the highest amongst other countries in the world.

(Vatsal Gosalia, National Law University, Mumbai)