Milk producers are desperately opening new bank accounts to receive cheque payments, but they don't intend to remain cashless for long.

“I haven’t been paid for any of the milk I sold in the past 50 days,” said Govindbhai Rabari, a 70-year-old dairy farmer from Timba who looked utterly lost in the corridors of the bank. “The doodh mandali mantri [dairy cooperative secretary] can only pay by cheque, and we don’t know how much longer cash will take to come back, so I am finally opening this bank account.”

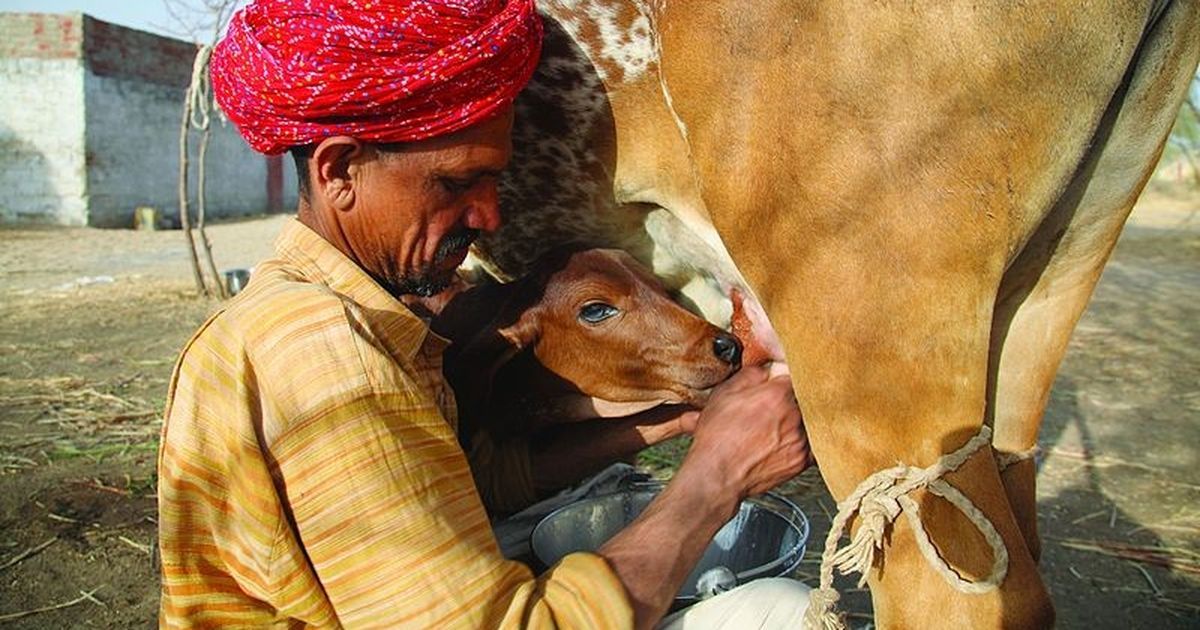

Dairy farmer Govindbhai Rabari is completely new to the banking system. Photo: Aarefa Johari

In the villages of Gujarat, the heart of India’s milk revolution, dairy farmers like Rabari have been among those most severely hit by the central government’s sudden decision to demonetise Rs 500 and Rs 1,000 currency notes on November 9. With local banks acutely strapped for cash and their dues stuck in the bank accounts of dairy cooperatives, hundreds of dairy farmers have spent the past seven weeks without any pay.

Now, even as they desperately open new bank accounts to avail of their payments by cheque, Rabari and his fellow villagers are waiting for the “storm” of note-bandi to pass. “Once this whole thing is over, why would we need to use these bank accounts?” said Rabari. “It is much more practical to get our payments in cash.”

The base of the milk supply pyramid

Gujarat’s dairy cooperatives, which source milk from individual dairy farmers in villages, have been “cashless” at the state, district and block levels for a long time. Large milk federations like Amul buy milk every day from district-level cooperatives, who buy their milk from block- or taluka-level cooperatives called sanghs, which in turn purchase milk from village mandalis.

Typically, business is done by cheque. But these cashless transactions are not the norm at the base of the pyramid, at the level of the individual dairy farmer who has no time for bank visits between grazing his cattle, milking them and delivering milk twice a day to village dairy mandalis.

On December 24, the central government noted the distress of dairy farmers across the India’s 1.70 lakh dairy cooperative societies. It directed major milk production agencies like Amul, Mother Dairy and the National Dairy Development Board to ensure that all dairy farmers opened bank accounts by December 30, so that cashless payments could be made to them for the milk they have been supplying.

However, neither farmers nor dairy cooperative owners believe the bank accounts will make much difference.

Can cashless work?

“Dairy farmers need cash to buy essentials for their cattle and their homes, and I usually pay them every 10 days for all the milk they have delivered,” said Tejabhai Tamaliya, the secretary of a milk cooperative in Surendranagar’s Diksar village. Tamaliya’s cooperative has 150 members, whom he needs to pay at the current rate of Rs 5.9 per kilo fat of milk – the amount of milk that would yield 1 kilo of fat. Since most of them haven’t been paid in 50 days, Tamaliya now owes his members a total of nearly Rs 15 lakh.

“I have the money in my account, but a withdrawal limit of just Rs 24,000 a week is too little – and it’s not like the cooperative bank is able to give us even that much cash each week,” said Tamaliya, who has made numerous trips to the Surendranagar District Cooperative Bank head office since November 10 to introduce mandali members to the banking system.

“From what I have seen, each village has barely five or six residents who are literate enough to understand banking, cheques, cards and online payments,” he said. “And travelling 25 km to a bank takes up too much time and money, so villagers are finding it very difficult to switch to cheques.”

Tejabhai Tamaliya, a dairy cooperative secretary, at the Surendranagar District Cooperative Bank.

Restricting cooperative banks

For milk mandali owners, the delay in payments to dairy farmers is not the only problem triggered by demonetisation. Depositing and exchanging their own old notes of Rs 500 and Rs 1,000 has been a challenge, because of the central government’s restrictions on district central cooperative banks.

These banks, recognised by the Reserve Bank of India, have been set up in every Indian district primarily to serve the banking needs of agro-based cooperatives in rural areas. By default, milk cooperative societies rely on accounts in district cooperative banks for their financial transactions. In many talukas, these cooperative banks are the only locally available banking options for rural citizens.

On November 15, barely a week after demonetisation was announced, the central government banned all district cooperative banks from exchanging or depositing demonetised currency notes. The decision was driven by a fear that accounts in these banks could be misused to convert black money to white, but for the first few weeks after demonetisation, it proved crippling for members of agriculture and dairy cooperatives.

Unable to deposit old money into their own accounts, farmers and dairy owners struggled with a severe cash shortage. “To make matters worse, for a week in November, district cooperative banks were not even supplied with new notes to distribute amongst customers,” said Sagar Rabari, secretary of the Gujarat Khedut Samaj, a state-wide farmer’s association.

District cooperative banks in Gujarat have been fighting back against the government’s move. Dilip Sanghani – a Bharatiya Janata Party leader from Gujarat’s Saurashtra region and the chairman of the National Federation of State Cooperative Banks – has been particularly vocal about the adverse impact of this ban on farmers.

The Bhavnagar District Cooperative Bank has also sued the central government and the Reserve Bank of India in the Gujarat High Court, seeking an explanation on the validity of restricting note exchange and deposits at Gujarat’s 18 district cooperative banks. As of now, even after the government’s 50-day deadline for ending demonetisation woes passed by on December 30, the court case has not moved far.

Meanwhile, at the head office of the Surendranagar District Cooperative Bank, manager SM Mori is tight-lipped about the troubles of his many account holders. “Since we don’t have government permission to touch their old notes, they must have opened accounts in other banks,” he said, before turning the conversation to the helpless “cash-bandi” his bank is facing.

“Ideally we would need at least Rs 10 crore every 10 days if we wanted to distribute Rs 24,000 per week to our account holders,” said Mori. “But what we get from the Reserve Bank is just Rs 3.5 crore every 10 days. We try to distribute it equally in all our 14 smaller branches in the district, but obviously, it is not enough.”

Courtesy: Scroll.in