With Spiralling Public Debt, now India Follows the infamous Gujarat Model

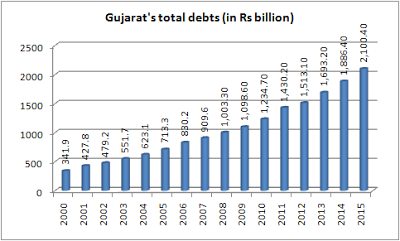

Narendra Modi came in as chief minister of the state in October 2001 and when he stepped into the state’s chief ministership post, Gujarat's debt stood at roughly 53,000 crore rupees. When he left his post, elevated to become prime minister, the public debt of the state of Gujarat was 165,000 crores.

That is, the state he led was several thousand crores more deeply in debt. Much of the spending was and is on showpiece infrastructure projects, while spending on health and other social sectors were and are low. Now it's appears that it’s India's turn to sink as we follow the same pattern of public borrowing and call it a successful ‘model.’

Earlier this year, then Gujarat state finance minister, Saurabh Patel, replying to a written question by MLA from Lunawada, Hirabhai Patel had, in the state assembly on February 25, 2016 stated that to date, the state of Gujarat owes Rs 1,65,742 crores in public debt, the Economic Times reported this. Today, after the Dalit Una agitation the state finance minister’s portfolio has been handed over to Nitin Patel. Saurabh Patel had also said that the government had paid a cumulative and whopping amount of Rs 54,349 crores as interest and principle during last three financial years.

In 2012-13, the state government has paid Rs 10,883 crores as interest and Rs 6,537 crores as principle amount against the loans taken by the state, the Minister said. In 2013-14, state has paid Rs 11,916 crores as interest and Rs 6,204 crores as principle. In 2014-15, the amount was Rs 13,297 crores and Rs 5,512 crores respectively, Patel said. In March 2012, when Gujarat's actual debt was Rs 1,38,978 crores and projected to touch Rs 1.76 lakh crores in 2013-14, was preceded by only two other states: West Bengal (Rs 1.92 lakh crores) and Uttar Pradesh (Rs 1.58 lakh crore), according to these figures.

These figures put into shadow the much acclaimed and not critically assessed ‘Gujarat Model of Development.’ Huge social upheavals among Gujarat’s Dalit (7 per cent of the state’s population and the Patels (Patidars) have exposed this model of development, though much showcased, as making hollow claims.

This report in Counterview (Gujarat's total debts or liabilities cross 2.1 lakh crores, up by 10.19% in a year) revealed how, the Reserve Bank of India (RBI) Study of state budgets(2015) has revealed that Gujarat’s outstanding liabilities, also identified as “total debts”, have crossed Rs 2 lakh crore in 2014-15, reaching Rs 2,100.4 billion, or a little above Rs 2.1 lakh crore, up from Rs 1,886.4 billion in 2013-14, a 10.19 per cent rise.

While critics consider this a very “heavy debt burden” on the state coffers, Gujarat government officials do not think there is anything alarming here, as one should look at the ability of a state to pay debts instead of talking of debts in absolute terms.

Market borrowings topped appear to have topped Gujarat’s “total debts” for the year 2014-15. These include internal debts, which were to the tune of Rs 1,613.8 billion, followed by state development loans (SDLs) of Rs 1,058 billion. Other “outstanding liabilities” include power bonds, national small savings funds, loans from banks and financial institutions, loans from the Centre, provident fund, and so on.

By calculating outstanding liabilities, the RBI believes that there is a need to take a “broader” view of debts. It says, “In assessing fiscal sustainability, it is important to focus attention on a broader concept of debt. Sustained efforts by the states are required to keep debt levels from rising.” According to the RBI, earlier calculations, which only took into account public debt, was limited in definition, underling, “Conventional debt does not include the governments’ risk exposure to PSUs due to government guarantees, off-budget borrowings and accumulated losses of financially weak PSUs.”

The states which have higher outstanding liabilities than Gujarat are Maharashtra with Rs 3,387.3 billion, followed by Uttar Pradesh (Rs 2,936.2 billion), West Bengal (Rs 2,804.4 billion), and Andhra Pradesh (Rs 2,204.5 billion). All other non-special category states have much less amount of outstanding liabilities than Gujarat’s.

Significantly, despite a high debt burden, Gujarat’s outstanding liabilities as percentage of Gross State Domestic Product (GSDP) – which is considered the yardstick for calculating whether a state has capacity to pay the loans it taken – remains well within the permissible limit. Identified as debt-GSDP ratio, it was 25.3 per cent in 2011-12, and in 2014-15 it is 23.7 per cent. The “permissible limit”, as worked out by the Finance Commission, in 2011-12 for Gujarat was 31.9 per cent, while it was 19.1 per cent in 2014-15.

The RBI notes in the study titled “State Finances: A Study of Budgets of 2014-15”, states, “Setting the consolidated debt-GDP ratio of states on a declining trajectory is crucial to improving their finances.” It adds, “Halting the deterioration in the GFD-GSDP ratio that took place in 2013-14 is also critical in the context of fiscal consolidation.”

The RBI quotes other studies to say that a gradual fiscal consolidation based on a mix of revenue and expenditure measures can support growth, while reducing public debt. Higher initial levels of debt may also increase the probability of government pursuing successful fiscal consolidation.”

The RBI study further reveals that 52 per cent of Gujarat’s debts are more than seven years old, 24 per cent between 5 and 7 years old, 19.6 per cent between 3 and 5 years old, 2.5 per cent between 1 and 3 years old, and just about 1.8 per cent less than a year old. The percentage of loans of less than a year old is lowest among the 18 “non-special category states”.

As of 2014 figures when the political transition took place in the state, Reserve Bank's data shows that Gujarat received $9 bn in Foreign Direct Investments (FDI) between April, 2000 and December 2013, adding that Maharashtra received the highest FDI during the said period ($65 billion), followed by Delhi ($38.8 bn) and Chennai ($12.6 bn). In 2011, Narendra Modi had claimed during the famed Gujarat summit that that the state had finalised FDI agreements worth $450 bn.“Just add it (the numbers). This was a ludicrously high figure since it is five or six times higher than what all of India had received in total FDI until 2014. http://finmin.nic.in/the_ministry/dept_expenditure/plan_finance/DEbt/state-fiscal-debt-liab.asp

Background:

Debt Obligations of Gujarat Government Crosses Rs 50000 Crores Mark

Gujarat Economy in Doldrums, Ensuing Government Will Find Itself in Trap

With every passing year, the public debt of Gujarat government is soaring high and high. Not only this, towards payments of interest on this debt Gujarat government has to rely on its revenue receipts and fresh loans. The state, which surpassed the statutory limit on overdrafts last year, finds its economy in sorry state. Economists have pressed their advice that if the government fails to act on timely repayment of its debts and interest payments there on, it will affect a severe blow to treasury. Sources in the finance ministry had then said that the total fiscal liabilities of Gujarat government has crossed Rs 50000 crores mark. If the state remains gripped by the debt trap in years to come, the ensuing government will have to face a critical situation. On the other hand, national and international financial institutions will hesitate to give grants and loans to Gujarat government.

The state economy should ideally follow the cardinal principles of sustainability and non-vulnerability. Taking into account its Gross Fiscal Liabilities and Gross Domestic Product as well as Revenue Receipts suggest that the state is sinking under mounting debts. At the same time the Revenue receipts from its own taxes has not witnessed any noticeable increase, thus lending it into vulnerable position. During the last five years (1997-2002), the rate at which its interest payments rose, surpassed the rate of growth in its Gross Domestic Product, suggesting violation of sustainability principle.

The high level of gap between the total fiscal resources against its total fiscal liabilities suggest that without giving a thought to its resource mobilisation capacity, the state indulged in increasing liabilities indiscriminately. Comptroller and Auditor general of India has also pointed out in its report that the state is using a large part of its revenue receipts to repay its debts and towards interest payments, which suggests a negative trend for the state government. The report submitted by Indian Institute of Management, Ahmedabad, director Prof. Bakul Dholakiya in April 2003 suggests that the Gross Fiscal Deficit of the state is rising at the rate of 6.00%. The said report warns that if the state government wants to sustain its economy, this deficit has to be brought down to 3.50%. Gujarat state finds itself in 15th position amongst the 16 heavily indebted states. The report notes that while the burden of interest payment on debt was 16.9% of GDP in 1996-'97, it has become 46.6% of GDP in 2001-'02.

So, when looked from a retrospective angle, within last twelve years, the public debt has witnessed eight fold increase. Financial experts and sources in finance ministry suggest that at the end of the current financial year, the government will have to pay, merely as interests on it outstanding debts, the amount which equals to what it raises from its own sales tax.

From 1991-'92, how the total fiscal liabilities have increased by leaps and bounds is suggested in following table:

| At the end of the fiscal year | Total fiscal liabilities of Gujarat government |

| 1991-'92 | Rs 6919.82 crores |

| 1992-'93 | Rs 7750.78 crores |

| 1993-'94 | Rs 8240.28 crores |

| 1994-'95 | Rs 9183.15 crores |

| 1995-'96 | Rs 10448.99 crores |

| 1996-'97 | Rs 11976.00 crores |

| 1997-'98 | Rs 20139.00 crores |

| 1998-'99 | Rs 24757.00 crores |

| 1999-'00 | Rs 31561.00 crores |

| 2000-'01 | Rs 40007.00 crores |

| 2001-'02 | Rs 45304.00 crores |

According to sources the interests paid by the government on this mounting debt is as follows:

1999-'00: Rs 2808.00 crores

2000-'01: Rs 3100.00 crores

2001-'02: Rs 4200.00 crores

Sources also informed that the public debt of the state government has reached Rs 52000 crores mark, at the end of 2002-'03.

During the year 2001-'02 the state had paid back debts worth Rs 18510.44 crores. Out of this repayment on Government of India loans was Rs 742.24 crores, whereas to Reserve Bank of India it was Rs 17563.18 crores. Due to such damning resource crunch, the state government had to rely on overdraft eight times last year and paid Rs 2.17 crores as the interest on these overdrafts only. During the years 2000-'01 and 2001-'02 also it had to take overdrafts, 11 times and 10 times respectively. The highest amount generated from overdraft last year was Rs 589.30 crores.

Central government has warned the state that if it fails to minimise its debt obligations and restore economic sustainability, the Centre will have to think twice before giving it any grants or loans.

(Source: Gujarat Samachar, Baroda edition, June 28th, 2003. Page 16.Translated by : Himanshu Upadhyaya)