Cash reserves of the oil and gas explorer fell by 92% in a single year from FY 2016-17 to FY 2017-18 as, besides high dividend payouts to the government, it was forced to bail out debt-ridden GSPC and buy govt stake in HPCL.

This has changed. After successive governments had gradually milked ONGC, the oil & gas explorer has completely run dry after the Narendra Modi government took over.

ONGC — a central public sector enterprise developed in the late 1950s and 1960s — is key to India’s energy security.

Of course, the Congress regimes since the early 1990s began chipping away at the central public sector enterprise in favour of private businesses looking to dig into the inordinately profitable oil and gas industry.

In 1992-93, a total of 28 prime oil and gas fields that were discovered and developed by ONGC were given away to private parties for a pittance.

In fact, the Indian government in 1991 forced ONGC to take a loan of $450 million from the World Bank with attached conditions mandating that the oil fields discovered by ONGC and Oil India, another state-owned enterprise, would have to be developed as joint ventures with private and foreign capital.

But ONGC remained among the top cash-rich companies of India — contributing around 70% to India’s domestic production.

Over the past four years, however — as the Bharatiya Janata Party-led National Democratic Alliance regime under Narendra Modi has continued to suck out cash from profitable public-sector companies in ‘inventive’ ways — ONGC has not only exhausted its accumulated cash reserves, but is now under a mountain of debt, thanks to unnecessary acquisitions that it was forced to make by this government.

Last November, the Oil Ministry had been pushing to sell 60% stake in prime oil and gas producing fields of ONGC to private companies, but the attempt was unsuccessful owing to strong opposition from the state-run company.

But before we look at the various ways that the Modi government employed to drag down ONGC, let us take a brief look at the company’s financials as reflected in its yearly balance sheets (which can accessed inside its annual reports) for the past four fiscals.

The financials tell the story of ONGC’s downhill slide — engineered by the Modi government — which is not just sorry but scary for India’s energy future.

What The Financials Say

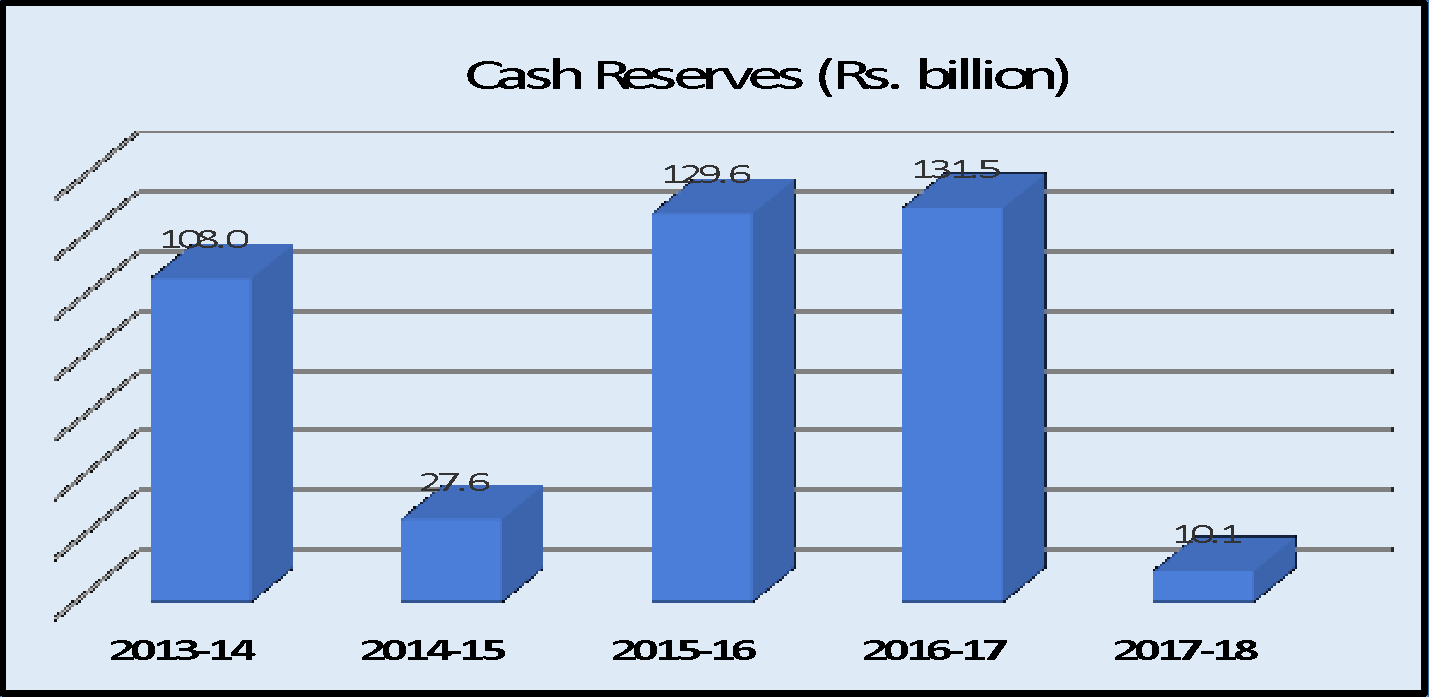

This June, Bloomberg had reported that ONGC’s cash levels in the year ended March 2018 (FY 2017-18) were at their lowest since the year ended March 2001 (FY 2000-01) — and had dropped by more than 90% in one year from FY17 to FY18.

Indeed, a look at the balance sheets corroborates this.

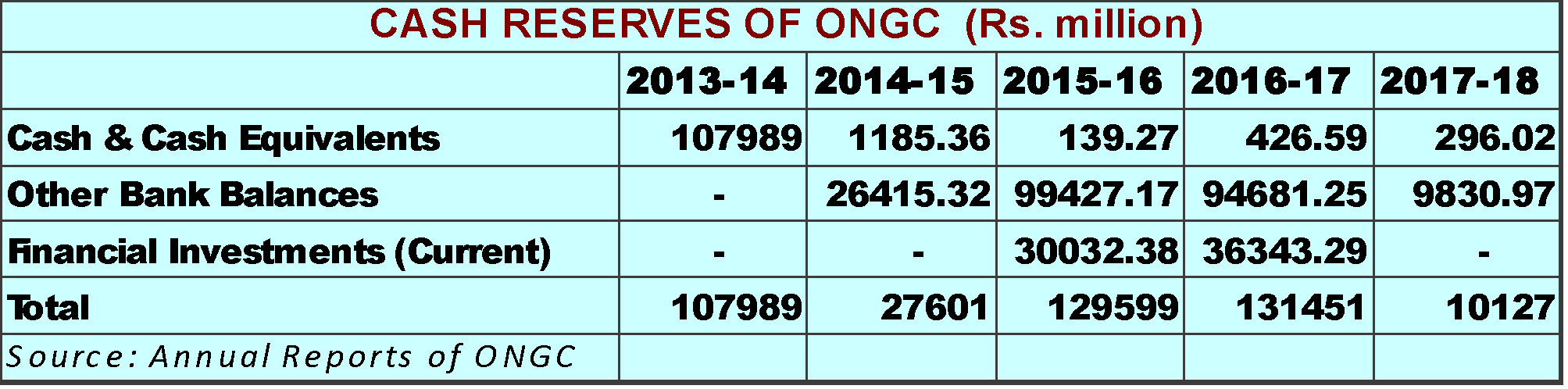

Below we have the cash with ONGC (counted here as Cash & Cash Equivalents + Other Bank Balances + Current Financial Investments) over the past five years — from FY2013-14 to FY2017-18.

We can see that in FY2015 — the first fiscal after Modi came to power in mid-2014 — there was a fall of around 74% in the cash levels from the year before. Cash reserves are used for capital expenditure, which is massive for oil and gas companies undertaking exploration of hydrocarbon reserves. Cash reserves are also used for paying the annual dividends — a share of the profit earned by a company paid to its shareholders.

This is the same year, 2014-2015, when ONGC was overtaken by Mukesh Ambani’s Reliance Industries as India’s most profitable company. ONGC had posted a consolidated net profit of Rs 18,334 crore that year, and it slipped to the third position.

There was recovery in the cash levels in FY2016 and FY2017.

However — from 2016-17 to 2017-18 — the company’s cash levels dropped steeply, by 92%.

There are a number of reasons why this has happened.

Dividend Payouts

ONGC has been among the highest dividend-paying public-sector companies. But the government has been treating it as a cash cow — and has been regularly extracting extra or ‘special’ dividends from the company, just as it does from other profitable public sector companies, especially oil and gas companies.

In 2013-14, ONGC paid a total dividend of Rs 81.3 billion (Rs 81,2771.70 lakh). Again, in 2014-15, the company paid a total dividend of Rs 81.3 billion (Rs 81,2771.55 lakh).

In 2015-16, ONGC had a dividend payout of Rs 72.7 billion (Rs 72,7216.6 lakh). In 2016-17, the company paid a dividend of Rs 77.6 billion (Rs 77,6410.7 lakh).

However, in 2017-18, ONGC paid its highest dividend ever of Rs 84.7 billion (Rs 8,470 crore). All of these dividends mentioned here are without counting the dividend distribution tax paid.

Fuel Subsidy

What’s more, ONGC and other state-owned oil companies, such as Oil India Limited (OIL), have been regularly asked to share the fuel subsidy burden, with the government refusing to pay the entire subsidy. So, ONGC had to pay for fuel subsidy — selling oil to refiners at a discount — as oil prices soared. This obviously cut into the profitability of the company.

In 2014, the public sector explorer was asked to pay a record subsidy of Rs. 56,384 crore (Rs 563.84 billion), an increase of 14% from the subsidy paid the previous fiscal, so that state-owned fuel retailers could cover the losses incurred in 2013-14.

For just the quarter ended December 31, 2014, the company was asked to pay Rs 8,716 crore. In June 2015, ONGC and OIL had both made contributions of over 40% of the annual subsidy bill.

The government had again been asking ONGC to bear the fuel subsidy this time to bring down petrol prices, but the company resisted and was exempted — given its dire financial situation, with ONGC chairman Shashi Shanker admitting in June this year that the company was “already in the red.”

But how did ONGC end up “in the red”?

While the high dividend payouts and fuel subsidies can explain the fall in ONGC’s cash and profitability in the 2014-15 fiscal, what happened in FY2017-18 that the cash levels fell by 92% — from over Rs 130 billion to around Rs 10 billion?

This is where we come to the two most destructive moves by the Modi government as far as ONGC’s cash situation as well as its future is concerned — getting ONGC to bail out the debt-ridden Gujarat State Petroleum Corporation (GSPC) and to buy the central government’s stake in the Hindustan Petroleum Corporation Limited (HPCL).

Bailing out debt-ridden GSPC

In August 2017, ONGC was made to acquire all of the 80% stake of Gujarat State Petroleum Corporation Limited (GSPCL), owned by the Gujarat government, in a gas block of the Krishna Godavarari (KG) basin — the KG-OSN-2003/1 DDU (Rajamundry off shore in Bay of Bengal) field — for nearly Rs 8,000 crore (Rs 80 billion).

For this, ONGC paid around Rs 74.8 billion in FY 2017-18, according to its website.

The field was auctioned during 2003 under the erstwhile New Exploration Licensing Policy (NELP), which has now been replaced by the Hyrdrocarbon Exploration and Licensing Policy (HELP) approved in March 2016. In 2005, the GSPCL claimed that the KG-OSN-2003/1 field was the discovery of the century for India.

However, the block did not see any commercial production by late 2015 since the time it was discovered. GSPCL has debt of Rs 19,576 crore, for which they paid interest of Rs 1,804.06 crore per year.

So, buying the block from GSPCL is nothing but a losing proposition for ONGC.

Buying HPCL After Taking Debt

In January 2018, ONGC was forced to acquire the central government’s entire 51.11% equity stake in Hindustan Petroleum Corporation Limited (HPCL) — only so that the Modi government could meet its fiscal deficit target.

In fact, ONGC was forced to buy the HPCL stake for Rs 36,915 crore (Rs 369 billion) — at a price that was 14% higher than the market rate, HPCL’s closing share price, on January 31, 2018.

Most devastatingly, this deal pushed ONGC into high debt — ONGC was compelled to borrow Rs 35,000 crore (Rs 350 billion).

ONGC borrowed this sum as short-term (one-year) loans from four public sector banks and three private banks — Rs 7,340 crore from State Bank of India; Rs 4,460 crore from Bank of India; Rs 10,600 crore from Punjab National Bank; Rs 1,600 crore from Export–Import Bank of India; Rs 4,000 core from HDFC Bank; Rs 4,000 crore from ICICI Bank; and Rs 3,000 crore from AXIS Bank.

As per ONGC’s balance sheet for FY 2017-18, the company has borrowings of Rs 255,922.08 million (Rs 25,592.2 crore).

Selling Stake To Pay Off Debt

Speaking to Newsclick on condition of anonymity, an ONGC official and member of the ONGC Workers’ Union said the company was planning to raise money to pay off its debt by selling its shares in the state-owned Indian Oil Corporation (IOC) and GAIL.

ONGC has 13.77% shares in IOC and 4.86% shares in GAIL that were purchased under the Government of India’s buyback policy earlier.

The official said ONGC was planning to sell the IOC and GAIL stakes to the state-owned Life Insurance Corporation of India (LIC).

“But LIC put a condition that it would only buy the stakes at a concession of 10% as compared to the market rate. But ONGC refused this and decided to sell in the market instead, even though we won’t realise the amount in one shot if we sell in the market. Currently, there are some technical problems that we are dealing with for selling in the market. So the sale is yet to happen,” he said.

He said, that in fact “the management was planning to sell off ONGC’s stake in OPAL (ONGC Petro Addition Ltd), a new joint venture in Gujarat. But the employees’ union opposed the sale and requested the management to instead sell IOC and GAIL stake.”

Given the extremely capital-intensive and high-risk nature of oil exploration activities, the current situation is extremely dangerous for ONGC’s future. In any case, cash reserves are required for capital expenditure — which is critical for oil and gas companies to invest in exploration and production.

As Bloomberg says, ONGC has started work on its largest-ever oil and gas exploration project, which will require investments of more than $5 billion over about four years.

Recently, the Modi government held the first auction of oil and gas exploration blocks in the country in eight years, under the new and ‘liberalised’ Open Acreage Licensing Policy (OALP), and awarded 41 blocks out of 55 to Anil Agarwal’s Vedanta Resources. ONGC was given just two blocks. The ostensible reason that was reported in newspapers was that the bids made by ONGC were “conservative” and showed “extraordinary risk-aversion.”

Given the state ONGC has been reduced to by the government, is it any wonder that the country’s largest crude oil and gas company is being risk-averse?

“ONGC had been a debt-free company since 2001-02. The cash reserves can be built up again,” said the ONGC official to Newsclick, “but the company needs to become debt-free first.”

Union in Gujarat Writes to Modi

Meanwhile, in a letter dated September 4, 2018, the ONGC Employees’ Mazdoor Sabha in Gujarat wrote to PM Modi, raising the issues of the GSPC and HPCL deals, and stating that “constant interference” by the government had turned ONGC from a “cash rich company to a high debt company.” ONGC officials have also asked the government to exempt the company from the share buyback plan.

Giving a notice of three months for the Modi government to stop interfering in ONGC’s decision-making, the union in its letter has warned of “resorting to any direct action, as deemed fit, by the Confederation of Trade Unions in ONGC, without giving any further notice.”

Courtesy: Newsclick.in