India’s shadow banking system is in deep trouble. An imminent crisis has been slowly but surely brewing in India’s shadow banking sector for the past one year. The first signs of trouble in this sector emerged in June 2018 when Infrastructure Leasing and Financial Services (IL&FS) – a major non-banking financial company – defaulted in payment obligations on inter-corporate deposits and commercial papers[1] worth Rs 4.5 billion.

Thereafter, a string of defaults by IL&FS group’s subsidiaries on bank loans, short-term deposits, and commercial papers during July-September sparked turbulence in the entire financial markets and raised fears of a Lehman-like crisis.

When major institutional shareholders refused to rescue the debt-laden IL&FS, the Government of India decided to take control of the company to prevent financial contagion. The government was worried that the collapse of IL&FS would transmit multiple shocks to the entire financial system due to higher levels of interconnectedness. On October 1, the government superseded the IL&FS board and appointed six new directors to revive the ailing company. The government also ordered an investigation by the Serious Fraud Investigation Office into the affairs of IL&FS after several irregularities and corrupt practices by the previous management came into light.

Though this intervention by New Delhi averted what some commentators called a ‘mini-Lehman’ moment, but since then the hidden fault lines in India’s shadow banking system have been exposed.

What is a shadow bank? In simple terms, shadow banks refer to non-bank financial intermediaries that offer services like commercial banks but operate outside the banking system and are not subject to strict regulatory oversight. India’s shadow banking sector primarily consists of non-banking finance companies (NBFCs), housing finance companies, collective investment vehicles (such as money market funds, real estate funds, and fixed income funds), and structured finance vehicles.

The Domino Effect

The IL&FS default had a domino effect on the entire shadow banking sector as anxious investors started selling shares of other NBFCs and pulled out money from mutual funds that had exposure to the sector.

The second big shock came in September 2018, when DSP Mutual Fund sold commercial papers worth Rs3bn of Dewan Housing Finance Ltd (DHFL) – India’s third largest mortgage lender – at a higher yield, thereby triggering a 60 percent intra-day crash in company’s share price on September 21. The abrupt sale put financial markets in panic mode dragging other NBFCs stocks as well. As DHFL and other listed NBFCs are closely inter-linked with the rest of the financial system, the debt market shocks were quickly transmitted to equities markets. In the following weeks, credit rating agencies (CRAs) downgraded the DHFL while some other non-bank finance companies were put on credit watch.

Cut to now, several NBFCs are finding it increasingly difficult to meet payment obligations as borrowing rates have risen sharply besides banks and mutual funds have become cautious to lend money the non-banking finance companies, irrespective of their financial soundness. There is a looming fear that some NBFCs may default on their debt obligations in the coming months.

To avert a default in payment obligations, the liquidity-starved NBFCs have already initiated the sale of loan portfolios and assets. For instance, when DHFL missed payments on non-convertible debentures on the scheduled date (June 4, 2019), the company sold its entire stake in Aadhar Housing Finance to an investment firm owned by Blackstone Group to meet its payment obligations within seven days of the grace period and thereby prevented a default. Massive consolidation in India’s shadow banking sector is in the offing.

Some big conglomerates in the shadow banking sector may be able to raise funds from international markets as the Reserve Bank of India – the country’s central bank – has recently allowed them to tap into the offshore credit markets to overcome liquidity squeeze. However, it would introduce an additional risk – that of foreign exchange rates. Besides, the money raised through international markets would be mostly utilized to pay off the liabilities from existing debt, rather than creating new businesses.

Make no mistake, the liquidity crunch will have severe ramifications on the real economy as sectors such as automobiles, consumer durables, housing, and commercial real estate are heavily dependent on financing from NBFCs. If the liquidity crunch prolongs, consumption demand will decrease, thereby adding further downward pressure on growth.

From a public interest perspective, what is worrisome is the likely impact on the savings of millions of salaried people and pensioners because several pension and provident fund trusts have high exposure to debt-ridden NBFCs. For instance, pension funds and provident fund trusts have a combined exposure of Rs91bn to IL&FS group[2] and Rs33bn to DHFL[3] – not an insignificant amount of money.

Flawed Business Model of Shadow Banks

The business model of NBFCs is inherently flawed due to asset-liability mismatch. They borrow short- term and lend long-term. For instance, an NBFC will raise funds by selling short-term commercial papers (3 to 6 months duration) to banks or mutual funds and will subsequently lend this money as a vehicle loan with a tenure of 5 years. In good times, the NBFC can roll over commercial papers or raise new funds by issuing new commercial papers at regular intervals. However, in bad times, funding becomes difficult and more expensive for the NBFC, and consequently, the cycle of rotation of money gets broken.

Unlike banks, their reliance on short-term wholesale funding results in high and volatile borrowing costs.

Also, the use of excessive leverage by NBFCs amplifies the risks associated with asset-liability mismatches. In 2018, some large housing finance companies such as LIC Housing Finance and DHFL had reported a debt-to-equity ratio of more than ten times, clearly indicating a sign of financial vulnerability.

Furthermore, due to their exposure to niche segments, NBFCs also face significant business risks because some sectors (such as auto) are cyclical in nature.

The Rise and Fall of IL&FS, the Rolls-Royce of Infrastructure Financing

IL&FS was not an ordinary non-banking finance company. It was a poster child of the public-private partnership (PPP) model of developing infrastructure projects by the private sector in partnership with central and state governments. Established in 1987 by three state-owned financial institutions (Central Bank of India, Housing Development Finance Corporation and Unit Trust of India), its core mandate was to catalyze “the development of innovative world-class infrastructure in the country.”

The company expanded its portfolio rapidly in the 1990s as the policy emphasis on financing infrastructure projects shifted away from the public sector (tax revenues and borrowings) to PPPs. This enabling policy environment helped IL&FS to emerge as one of the key players in infrastructure financing and technical consultancy. The company spearheaded an investment boom in physical infrastructure projects such as roads, tunnels, water treatment plants, ports, and power stations.

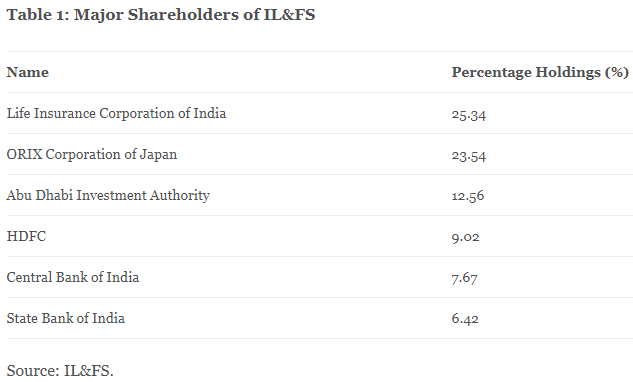

To fuel its ambitious plans, IL&FS received the backing from some of the big names in the finance industry. Currently, its largest institutional shareholders are state-owned Life Insurance Corporation of India, Orix Corporation (Japan), and the Abu Dhabi Investment Authority (see Table 1). Besides, many big institutional investors and private equity firms invested in the funds managed by IL&FS group’s subsidiaries. For instance, the California Public Employees’ Retirement System (CalPERS), the largest public pension funds in the US, invested $100mn in IL&FS India Realty Fund focused on real estate business in India. Over the years, IL&FS and its 348 subsidiaries raised billions of dollars from banks, mutual funds, pension funds, and other institutional investors. It amassed a debt of Rs910bn ($12.3bn) as on March 2018.

The group entities began to default in mid-2018 because of asset liability mismatch – funding long-term projects (of over ten years and more) with short-term borrowings. There is no denying that some of its construction projects were facing cost overruns owing to delays in land acquisition, forest clearance and disputes over contracts besides the rise in short-term interest rates also negatively affected the group’s financials. But these external factors alone cannot explain why IL&FS sank deeper into the mess.

Instead, the key factors responsible for the IL&FS crisis are poor corporate governance and weak risk management systems coupled with a lack of strict supervision by the RBI. The Serious Fraud Investigation Office (SFIO) has found substantial evidence of corruption and fraudulent practices by the senior management who enriched themselves with hefty salaries and perks.

The senior management deployed several tactics to window dress the balance sheets of groups companies. For instance, the SFIO found that IL&FS Financial Services (investing banking arm of Group) frequently indulged in evergreening of loans to its defaulting borrowers to avoid these accounts becoming bad loans in its books.[4]

The complex corporate structure of 348 subsidiaries enabled the senior management to hide the deteriorating financial health of the group from scrutiny. From 2013 onwards, the independent directors, as well as auditors, collided with the top management to conceal information and falsifying the books of accounts. In 2017, a whistleblower sought to uncover the fraudulent activities at the IL&FS, but his complaint was brushed aside by the then management and the auditors.

The CRAs issued the highest ratings of ‘AAA’ to the IL&FS without knowing its actual financial position while banks and other financial institutions kept on lending money to the group companies trusting the ratings issued by CRAs.

In 2018, the IL&FS group had the most leveraged balance sheet among the large NBFCs operating in the shadow banking sector. What is astonishing is that till August 2018, IL&FS bonds and debentures held ‘AAA’ ratings despite the group’s debt burden jumped 44 percent between 2015 and 2018, and its debt-to-equity ratio shot up to 18.7:1 in 2018. Just two months later, the CRAs downgraded ratings of IL&FS loans all the way down to ‘D’ (junk status), indicating actual or imminent default.

Post-crisis, fresh evidence has come to light that the government of India had issued a sovereign guarantee on behalf on IL&FS to international lenders way back in 2009 and has recently paid up on sovereign guarantees to the Asian Development Bank (ADB) and KfW – a German government-owned development bank.[5] The private placement document issued by IL&FS on August 10, 2015, also confirms that the Indian government issued sovereign guarantees to loans worth $100mn from ADB and $200mn from International Bank for Reconstruction and Development (IBRD)[6]. This issue warrants further investigation to ascertain why loans taken by a private firm (with significant foreign ownership) were issued sovereign guarantee by New Delhi.

Going forward, it may take a few years to get the company back on its feet. Only a few of IL&FS group’s assets can be quickly monetized. A large part of its investment portfolio is illiquid, which means that the company may not be able to meet all its payment obligations on time through the asset monetization process.

India’s Burgeoning Shadow Banking Sector

According to the latest statistics of Reserve Bank of India, more than 11,402 firms with a combined balance sheet of Rs22.1tn operate in India’s shadow banking sector.[7] They carry out a wide range of activities like asset financing, equipment leasing, infrastructure financing, housing loans, vehicle loans, consumer loans, and microfinance. Currently, the NBFCs and HFCs account for about 17% of total credit in the country.

Majority of firms are privately owned but a few large state-owned shadow banking firms (such as Power Finance Corporation Limited and Rural Electrification Corporation Limited) also exist. Of late, a few firms have become financial services conglomerates offering a wide range of financial services and products.

From a financial stability perspective, NBFCs with assets of Rs5bn or more are categorized as systemically important firms that are subject to prudential regulations such as capital adequacy requirements, albeit much lower than commercial banks. In 2018, the RBI classified 249 non-deposit accepting NBFCs as systemically important firms.

The shadow banking sector has witnessed robust growth in recent years as India’s commercial banks drastically reduced their exposure to infrastructure and industry due to a sharp rise in non-performing assets. This provided a fillip to NBFCs to expand their footprint in housing, construction, asset finance, infrastructure, auto finance, and consumer finance segments.

The NBFCs carry out many functions like commercial banks. They lend money and make investments akin to banks, but it is important to note that NBFCs are not part of payment and settlement system and most of them are not allowed to accept deposits from the public. Unlike banks, the majority of NBFCs are also not subject to strict regulation and supervision that enables them to take on more risks than banks. The Reserve Bank of India does not regulate all NBFCs. Sectoral regulators regulate some NBFCs. For instance, housing finance companies (HFCs) are regulated by National Housing Bank; and Securities and Exchange Board of India regulates venture capital fund companies.

The NBFCs and HFCs borrow mostly from banks, mutual funds, insurance companies, and pension funds by issuing commercial papers and other debt instruments. According to the RBI’s Financial Stability Report (June 2018), NBFCs were the largest net borrowers of funds from the financial system with gross payables (current liabilities) of around Rs7.1tn and gross receivables (current assets) of just Rs419bn in March 2018.[8] While the housing finance companies were the second largest borrowers of funds with gross payables of around Rs5.2tn and gross receivables of Rs312bn in March 2018.[9] The report further notes that NBFCs received 44% of total funds from banks, followed by 33% from asset management companies managing mutual funds (AMC-MF), and 19% from insurance companies in 2018.[10]

Say Goodbye to Light-touch Regulatory Framework

The ongoing liquidity crisis in India’s shadow banking sector is a wake-up call for the government and regulators. Till now, the regulators deliberatively adopted a light-touch regulatory approach towards the shadow banking sector to promote innovation and enable last mile connectivity.

Over the years, the shadow banking sector has grown considerably in size, complexity, and operations under this approach. Its interconnectedness with the rest of the financial system has also increased due to greater exposure of commercial banks, mutual funds, insurance companies to shadow banking entities in recent years. As a result, any adverse development in the shadow banking sector can affect the health of the broader financial system and vice versa. We do not need to remind the regulators that the 2008 crisis originated in the shadow banking system (i.e., subprime mortgage market in the US), and quickly developed into a full-blown global financial crisis.

Since shadow banking entities could be a potential source of systemic risk, the regulators should mark a definitive break with the previous light-touch regulatory approach towards the sector. The challenges faced by the RBI and sectoral regulators are numerous. It includes ringfencing the current liquidity crisis, maintaining financial stability, and avoiding regulatory arbitrage between banks and non-banks. Meeting these multidimensional challenges require a coherent and quick regulatory response.

The long-lasting solution lies in enhancing the existing regulatory framework by increasing capital, liquidity, risk management, and disclosure requirements, rather than bailing out poorly managed NBFCs. For systemically important institutions that are “too big to fail,” additional regulatory requirements should be enforced. There should also be restrictions on the number of subsidiaries that can be established by a single group company operating as a shadow bank.

In addition, the surveillance of the shadow banking sector should be intensively carried out through off-site and on-site supervision.

Tighten Norms for Credit Rating Agencies

The IL&FS fiasco has put the spotlight on the role of auditors and credit rating agencies. While the Ministry of Corporate Affairs has initiated a move to bar the two auditors (Deloitte Haskins & Sells and BSR & Co) of IL&FS from practicing for five years for allegedly colluding with the management, similar stringent actions should also be initiated against the credit rating agencies as they failed to identify risks that would have warned lenders not to lend money to the company.

In a market-based financial system, the role of credit rating agencies is paramount to assess the financial strength of firms and financial instruments. Therefore, the authorities should address the weaknesses of the business model of CRAs and strengthen their accountability.

Revive Development Banks and DFIs

In India, repeated attempts to develop a vibrant long-term corporate bond market have not succeeded. Till the 1980s, state-owned development banks and development finance institutions (DFIs) used to provide medium-term and long-term project financing in India. However, their role was drastically reduced under the financial sector reforms introduced in the early 1990s as the withdrawal of concessional funding by the RBI made their business model unsustainable.

Consequently, Industrial Investment Bank of India was closed down while ICICI and IDBI were converted into full-fledged universal banks on the expectations that they will continue to extend medium-term and long-term loans with improved corporate governance norms introduced by diversified ownership and professional management. On both counts, ICICI Bank and IDBI Bank have belied these expectations.

The steady weakening of development banks and DFIs created a void that shadow bank entities attempted to fill with their inherently flawed business model. The time is ripe for revitalizing the existing development banks and set up new institutions that can finance infrastructure and other development projects that have large capital requirements and long gestation periods.[11] These institutions can also catalyze the financing of Sustainable Development Goals (SDGs) that India committed to achieving between 2016 and 2030.

Post the 2008 crisis, many other countries are recognizing the importance of development banks in tackling urgent societal challenges such as climate change, inequity, and inclusive growth.

Endnotes

[1] Introduced in India in 1990, commercial paper is a short-term debt instrument issued by financial institutions and corporates to meet short-term liabilities. The commercial paper is not backed by any form of collateral and therefore is an unsecured money market instrument. The CPs are issued for maturities between a minimum of 7 days and a maximum of up to one year.

[2] “‘Pension, provident funds have Rs9,134-cr exposure to IL&FS’,” The Hindu BusinessLine, April 12, 2019.

[3] Shayan Ghosh and Anirudh Laskar, “Over 40 pension, PF trusts have exposure of Rs3,300 cr to DHFL,” Mint, May 22, 2019.

[4] For further details on evergreening of loans, see the charge sheet filed by SFIO against IL&FS. Available at https://taxguru.in/company-law/charge-sheet-filed-sfio-ilfs.html.

[5] For details, see Sucheta Dalal, IL&FS Controversy: Centre is Paying Up on Sovereign Guarantees to ADB, KfW for Group’s Loan, The Wire, April 1, 2019; IANS, Centre pays sovereign guarantees to ADB, KfW for IL&FS, The Economic Times, April 3, 2019.

[6] IL&FS, Private Placement Offer Letter, August 10, 2015. Available at: https://www.bseindia.com/downloads/ipo/2015820143150IL&FS%20IM.pdf.

[7] Financial Stability Report, Issue No. 17, Reserve Bank of India, June 2018, p. 39.

[8] Ibid., p. 46.

[9] Ibid.

[10] Ibid.

[11] For a discussion on the role of development banks and DFIs in financing sustainable development, see Kavaljit Singh, Scaling Up Finance for Sustainable Development, Research Report, Madhyam, September 2018.

——

*Source: https://www.madhyam.org.in/