The savage effects of the ongoing economic crisis will destroy not just the present but the future of Indian families.

Representational image. | Image Courtesy: Rediff.com

Families are being forced to use up their savings and take loans in order to make ends meet, according to latest available figures from Reserve Bank of India (RBI). This means that future spending – for which savings were made – will be affected, and future incomes will have to be spent on repaying loans taken now. In other words, the slowdown is eroding the future living standards too, not just of today’s.

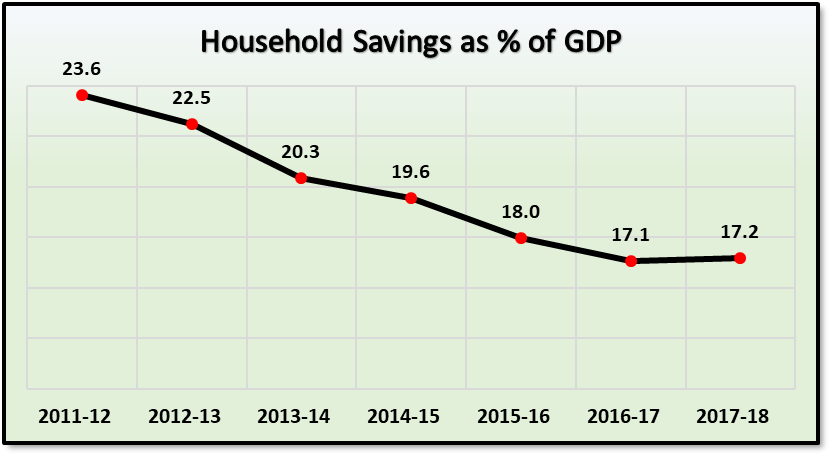

Household savings as a share of GDP have steadily declined from 23.6% in 2011-12 to 17.2% in 2017-18, the last year for which RBI data is available. [See chart below] It is believed that 2018-19 data will continue in the same declining direction, propelled by the slowdown impact. Taking savings as a share of GDP is necessary to bring out the real (inflation-adjusted) decline.

These household savings are made up of financial savings (like bank deposits, etc.), savings in physical assets (like houses) and savings in the form of gold and silver ornaments. Financial liabilities of households – like bank loans – are deducted to arrive at gross financial savings.

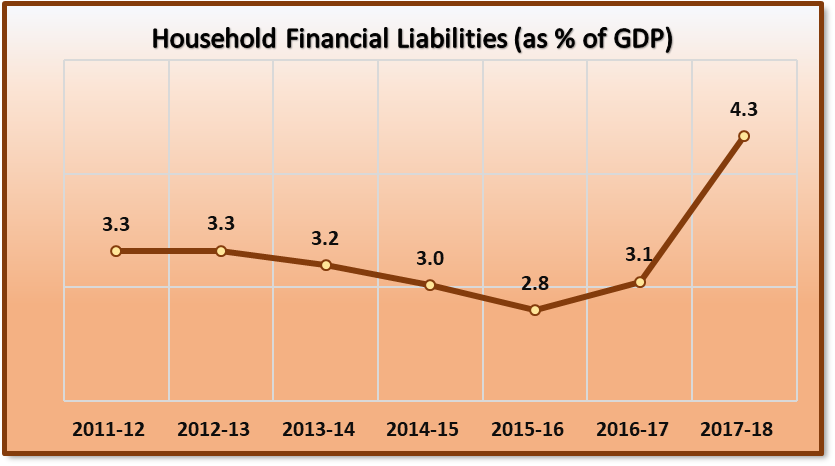

What is the other side of the coin – the liabilities of households? The same RBI source shows a slight dip in household liabilities from 3.3% of GDP in 2011-12 to 2.8% in 2015-16, and then a huge spike going upwards to reach 4.3% of GDP in 2017-18, the last year for which data is available. [See chart below] These are liabilities incurred annually.

It is clear that the roots of the current crisis go much beyond just the recent months. Besides bad monsoons and catastrophic events like the demonetisation of end-2016, the incipient jobs crisis and the inability of the first Modi government. to tackle the gathering crisis (visible in declining or stagnant credit flows, low capital formation, stagnating private consumption expenditure, etc.) led to the whole economy stuttering and fumbling into the current crisis. That’s why, savings have been dipping and household liabilities rising for the past few years.

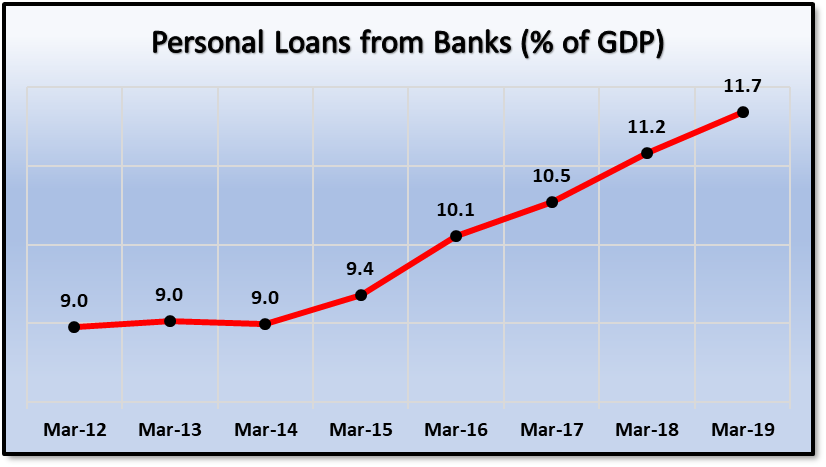

Now, let us turn to total outstanding debt of households incurred from banks. As the chart below shows, such outstanding personal loans have steadily increased from 2014, when they were 9% of the GDP to March 2019 when they had risen to 11.7% of the GDP.

What are these loans for? Mainly – about half of them – are housing loans. But there are also education loans, consumer durable loans and the rapidly rising credit card dues. Remember that these figures are total loans outstanding not annual additions, which is what makes these figures different from the financial liabilities discussed earlier.

Note that this spike in loans really takes off since Modi stormed into power in 2014. Till then it was stagnating. The Modi government has driven this debt-based spending, increasing the debt burden of families.

Taken together, these figures reveal the strain that government policies have put on families. Add to all this the fact that unemployment has been high and rising in this period, wages have been stagnating, earnings from agriculture have been abysmal and the small and medium sector of industries has been ruined by increased imports, and the twin shocks of demonetisation and GST – and you get a picture of the tremendous economic hardship that this government has caused. It seems unbelievable that it is the same government that promised achche din (good times).

Courtesy: News Click