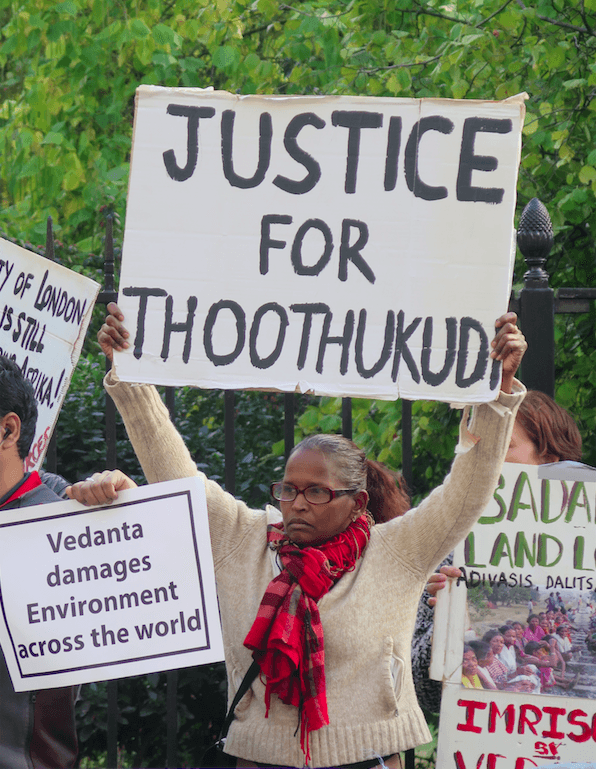

Loud protests took place at the company’s last London AGM today. Company founder and Chairman Anil Agarwal was not present, creating uproar among protesters and shareholders. Vedanta Resources officially de-listed from the London Stock Exchange at 8am this morning. Inside the meeting dissident shareholders asked questions about the police shooting of thirteen protesters against Vedanta’s copper smelter in Tuticorin, Tamil Nadu in May. Another shareholder asked how much Vedanta spent on litigation or bribes, given the number of court cases they are tied up in at their various operations. Meanwhile a large contingent of Tamil people played traditional Parai drums and demanded ‘justice for Tuticorin’ outside the AGM.

Hours before the meeting a protest was held at Financial Conduct Authority (FCA) headquarters in Canary Wharf, demanding that British regulatory authorities do not let Vedanta flee the London Stock Exchange without being held to account. Representatives for FCA Directors were handed copies of a damning report ‘Vedanta’s Billions: Regulatory failure, environment and human rights’, published by Foil Vedanta(1) and a coalition of organisations days before. The report was described by Hywel Williams MP as ‘deeply concerning and disturbing’ and gives a comprehensive account of legal judgments against Vedanta across its global operations, blaming the City of London and FCA for failing to regulate or penalise the company, which is the latest in a long list of London miners linked to ‘corporate massacres’.

On Thursday 27th September popular Zambian reggae artist and public figure – Maiko Zulu – was arrested outside the British High Commission in Lusaka, Zambia, holding a banner stating ‘Hold Anil Agarwal to account for Zambian crimes before de-listing’.1 Zulu gave this statement to the media, referring to the Vedanta subsidiary KCM’s pollution of the River Kafue, for which the landmark case of 1,826 farmers against Vedanta will be heard in London Supreme Court in January2, as well as the Tuticorin ‘massacre’:

“Vedanta is being de-listed from the London Stock Exchange following serious crimes against indigenous people of India and the pollution of our own Kafue River which is a source of livelihood for thousands of peasants. The inequality that multinationals are creating can not be left unchecked and we will continue standing up and facing arrests for the good of our people. Our fellow protesters were shot at by police in India.”

Thirteen people, including women and children were killed by police shooting on the 100th day of protest against Vedanta’s copper smelter in Tuticorin in May, as well as 217 injured, and nine disabled for life.3 Vedanta’s de-listing plans were announced shortly afterwards amidst global protests against the company. Fatima Babu, from the Anti Sterlite People’s Movement, one of the main groups involved in the protests says:

“The people of Thoothukudi are still reeling from the massacre of innocent women, men and children in May, which was carried out in the name of protecting Vedanta’s industry from the people whom it has polluted for so many years. The Tamil Nadu, Indian and British government’s must all take responsibility for the lawlessness and disproportionate power wielded by Vedanta, which led to this tragic event.”

On Sunday 31st October thousands of Adivasis (tribal) people protested against forced land acquisition for Vedanta’s steel plant in Saranda forest, West Singhbhum district, Jharkhand, India.

Samarendra Das from Foil Vedanta, primary author of the Vedanta’s Billions report, says:

“Anil Agarwal is so desperate to avoid public scrutiny following the Tuticorin massacre that he ran away from his own company AGM. We cannot him and his board escape accountability and justice in the UK, under whose jurisdiction they have committed widespread financial, human rights and environmental crimes. The FCA and City of London must now initiate proceedings against Vedanta or remain complicit in enabling and mitigating these abuses.”

The report ‘Vedanta’s Billions’, released several days before the AGM, is a summary of legal judgments against Vedanta across its operations, revealing its abusive modus operandi, with special focus on illegal mining in Goa, pollution and tax evasion in Zambia, as well as illegal expansion and pollution in Thoothukudi, Tamil Nadu, industrial disaster at Korba in Chhattisgarh, land settlement and pollution issues in Punjab, displacement and harassment of activists in Lanjigarh, Odisha, and a mineral allocation scam in Rajasthan.

Inside the AGM, dissident shareholders asked questions based on the catalogue of judgments against the company documented in the report. One question from a woman who has visited the concerned area will ask the company to respond to evidence of a pollution and a ‘land grab’ affecting primarily Dalits at the company’s Talwandi Sabo power plant.

The report notes that Vedanta is now the latest in a string of London listed mining companies linked to the murder or ‘massacre’ of protesters, including Lonmin, Glencore, Kazakhmys, ENRC, Essar, GCM Resources, Anglo Gold Ashanti, African Barrick Gold and Monterrico Metals. As such, the report names the role of the City of London and the Financial Conduct Authority in ‘minimising the risks associated with Vedanta’s legal violations and human rights and environmental abuses’ and failing to investigate or penalise any London listed mining company on these grounds.

The report concludes that;

“Some companies have de-listed due to a legitimate need to pursue long term company strategy, which may not be supported by shareholders’ emphasis on short term profitability. However in this case, Vedanta’s track record of human rights, environmental and financial violations, together with its already complicated financial structure, strongly suggests that de-listing is part of a policy to further limit public scrutiny of its operations.”

The report also includes a detailed diagram of Vedanta’s corporate structure, as it has evolved over the years, revealing the disproportionate number of shell companies registered in various tax havens, reflecting their opaqueness, contrary to their claim of being transparent.

Plaid Cymru MP Hywel Williams, who received a copy of the report, said:

“This is a deeply concerning and disturbing report. I will be taking note of its findings and seeking to ensure that MPs, policymakers and the Westminster Government are informed of its findings. The report once again emphasises the need for action by UK authorities to investigate and regulate London-listed corporations that carry out illegal and immoral acts overseas.”

In Goa, where all Vedanta’s operations are shut down due to a lack of appropriate permissions to operate, the State has begun the process of recovering value owed to it as a result of Vedanta’s illegal mining between 2007 and 2012. On 29th August this year Goa’s directorate of mines and geology issued a Rs 97.5 crore ($13.43 million) demand in respect of non payment of royalty for the financial years 2011-13.4

In Zambia, where the company was found guilty of a major pollution incident in 2006, and there is evidence of widespread transfer mis-pricing and tax evasion, Vedanta’s subsidiary KCM recently had its power supply partially cut by the Copperbelt Energy Corporation due to its refusal to settle a three month electricity bill5. Contractors and suppliers of KCM are also in a long term dispute with the company over non-payment of invoices.6

A prominent banner at today’s protest stating ‘Hall of Shame – the faces behind Vedanta’, pointed out the high level support the company has received from British and Indian former politicians and other figures. Vedanta Directors have included former High Commissioner of India – Sir David Gore-Booth, former Finance Minister of India – P. Chidambaram (who also appeared as counsel for Vedanta in a recent case7), former Home Secretary of India and Indian Ambassador to the USA – Naresh Chandra, mining mogul and former BHP Billiton CEO – Brian Gilbertson, former Rio Tinto CEO – Tom Albanese, and former Anglo American CEO – Cynthia Carroll. Former J. P. Morgan banker and one of the most well known dealmakers in London, Ian Hannam, advised on Vedanta’s listing as well as many of the City’s largest mining IPOs including Xstrata, BHP Billiton and Kazakhmys.

(1) Foil Vedanta is an independent grassroots solidarity organization focused primarily on the FTSE 250 British-Indian mining company Vedanta Resources PLC. Foil Vedanta targets the company in London where it is registered, as well as linking with people’s movements where Vedanta is destroying lives and devastating the land in India, Zambia, Liberia, South Africa and elsewhere.

(2) Vedanta Resources is a FTSE 250 diversified oil and mining company, who have been named the ‘world’s most hated company’ by the Independent newspaper for their long list of environmental and human rights crimes for which they are being opposed all over the world.9

1https://www.lusakatimes.com/2018/09/28/maiko-zulu-released-after-kcm-protest/

2https://en.wikipedia.org/wiki/Lungowe_v_Vedanta_Resources_plc

3https://timesofindia.indiatimes.com/city/madurai/its-official-217-hurt-during-anti-sterlite-protests-9-disabled-for-life/articleshow/64835110.cms?from=mdr

4https://www.firstpost.com/business/goa-slaps-rs-97-5-crore-penalty-on-vedanta-in-a-move-to-recover-gains-made-from-alleged-illegal-mining-5068961.html

5https://diggers.news/business/2018/08/30/cec-switches-off-power-at-kcm-for-failure-to-settle-electricity-bill/

6https://www.zambianpolitics.com/kcm-contractors-suppliers-complain-over-non-payments-zambian-politics-news/

7Chidambaram acted as counsel for Vedanta Ltd in a case regarding the illegal expansion of the Lanjigarh refinery. The judgment was in favour of SSNP. Vedanta Ltd vs Shenzhen Shandong Nuclear Power, pronounced on 31 August, 2018. High Court of Delhi, FAO(OS) (COMM) 35/2018 & CM APPLS. 8307/2018 & 11962/2018.

Courtesy: https://countercurrents.org/